Embracing Disruption

Supercharging clean energy storage capacities

Geopolitical disruptions and increasing extreme weather events around the globe highlight more clearly than ever the urgent need to further step up the clean energy transition. Large scale and flexible energy storage systems are creating the necessary backbone infrastructure to integrate growing renewable capacities. This transition helping to decrease the dependency from fossil fuels while facilitating the energy transition.

Key takeaways

- Building up clean energy storage capacities is crucial to the decarbonisation of energy system offering more flexibility and helping to decrease dependency from volatile fossil fuel prices

- Clean energy storage secures grid stability, and facilitates/accelerates the integration of renewables into the energy market

- Global battery energy storage market is projected to show a double-digit growth by the end of this decade

How energy storage can help stabilising the balance between energy supply and demand

Following a recent report of the International Energy Agency (IEA) renewable energy is set to be the dominant source of electricity by 2025, covering 90% of new capacity between now and the mid of this decade.1 Thanks to a record growth in renewable energy capacity and output, clean energy production will also be able to keep pace with the globally rising demand. However, natural energy sources such as solar, wind and water are subject to fluctuations (intermittency) which can confine their efficiency. Clean energy storage systems can secure grid stability and enhance the reliability of (green) energy supply as they allow to store excess energy and distribute it later, whenever needed.

Thus, keeping energy supply and demand in equlibrium by further enhancing energy storage capacities serves as a catalyst for the further growth of clean energy generation.

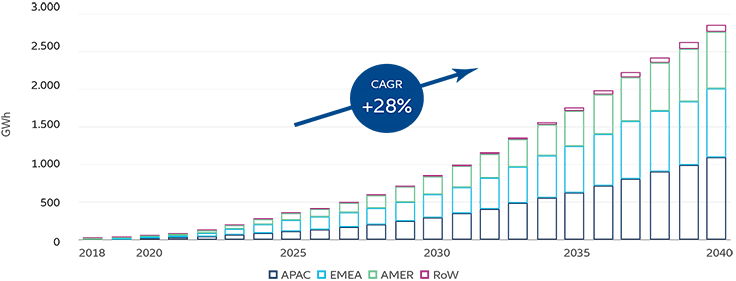

Global cumulative energy storage is expected to reach 2,850GWh by 2040

Source: Energy Storage Outlook 2019, BNEF 2019 July.

The variety of energy storage systems

Within these groups some options are most widely deployed to store large quantities of electricity.

Pumped hydro

In times of flat demand, water is pumped from lower to higher reservoirs. When demand surges, water is released to operate a turbine and delivering electricity to the grid.

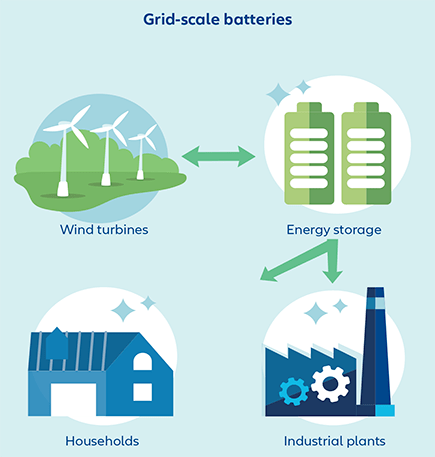

Grid-scale batteries

Electrochemical devices (lithium-ion, lead-acid, redox flow, etc.) that accumulate energy from the grid/power plant when electricity is plentiful and cheap and then discharge that energy later to provide electricity when required.

Solar thermal systems

Collection of energy by solar fields/photovoltaic systems that is discharged when demand is high and solar input low.

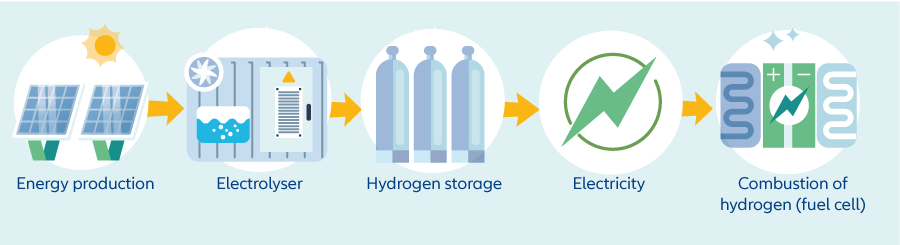

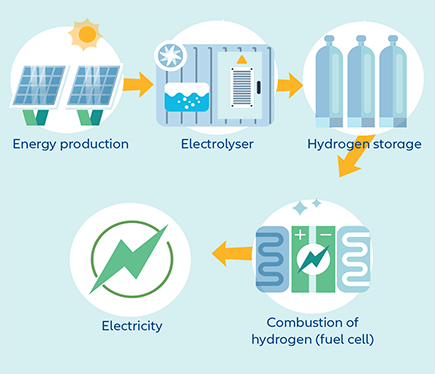

Hydrogen

Conversion of electricity into hydrogen which is then stored and re-converted into electricity. Although today its efficiency is still below other forms of storage systems, interest in hydrogen storage solutions – and here especially in Ammonia as a hydrogen carrier - is rising due to the significantly higher storage capacities than batteries, hydro or solar thermal technologies.

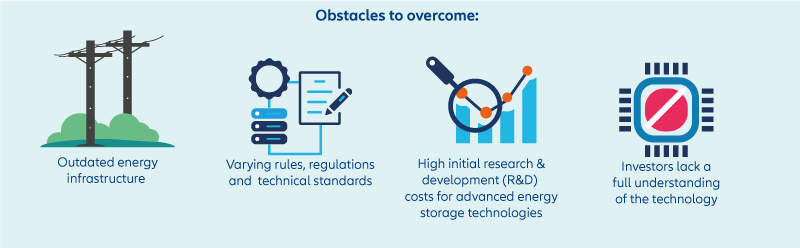

Tackling the challenges of energy storage systems

Despite the indisputable advantages energy storage systems and technologies add up to the clean energy transition, there are still high obstacles that must be overcome to establish the storage of clean energy as one of the main drivers of the transition to more sustainable forms of energy.

Energy storage, an indispensable part of clean power additions

While the global drive to decarbonise energy production and industries is predominantly focused on energy production, energy storage is gradually establishing itself as mission critical part of this transitional process.

Consequently, more and more governments and entities around the globe have recognised the need for action and implemented measures to foster the capacity expansion of energy storage systems as well as to intensify and finance the research and development of alternative technological storage solutions.

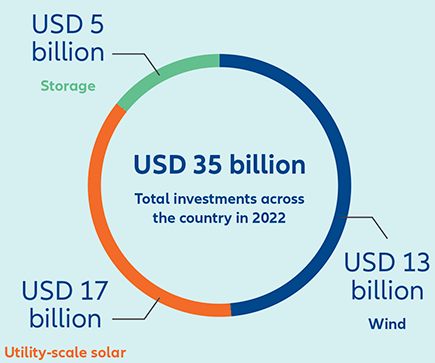

USA

On 1 January 2023 the Investment Tax Credit (ITC) under the Inflation Reduction Act (IRA) was extended to 5kWh or more stand-alone energy storage projects.2 Making these smaller scale projects eligible for an ITC disconnects developers from the need of coupling their storage solution directly with photovoltaic systems. This in turn reduces development times and costs for new energy storage capacities significantly.

This newly gained flexibility and the expansion of Investment Tax Credits to stand-alone energy storage systems might help to further push the already constantly growing US energy storage market.

Source: American Clean Power CLEAN POWER ANNUAL MARKET REPORT 2022, May 2023

Regional focus

New York State

New York State’s energy storage targets of 1,500 MW by 2025 and 3,000 MW by 2030 could not only result in roughly USD 3 billion in gross benefits but could also avoid more than two million metric tons of CO2 emissions and create around 30,000 jobs by 2030.3

California and Texas

In 2022, the “Golden State” and the “Lone Star State” took the top two places for US-wide clean energy additions including storage capacities.4

Texas and California, frontrunners in clean power additions in 2022

Source: American Clean Power CLEAN POWER ANNUAL MARKET REPORT 2022, May 2023

EU

On March 2023, the European Commission published a recommendation on energy storage highlighting that it can “play a crucial role in decarbonising the energy system, contributing to energy system integration and security of supply” and also stating that “a decarbonised energy system will require significant investment in storage capacity of all forms.”6 In this context EU member states are recommended to make detailed data accessible to facilitate investment decisions on new energy storage facilities.

EU’s push to build up energy storage capacities comes at the right time as the Commission assessed that the need for electricity system flexibility could grow to 30% of total electricity demand by 2050, a plus of 11% compared to 2021.

Latin America

According to recent analysis, in 2022 the solar energy storage market in Latin America amounted to USD 1.84 billion. Within the next five years it is set to grow at an annual rate of 7.20%.5

Investment in enablers can help scaling up clean energy storage capacities

With energy produced from renewable sources gradually and globally overtaking fossil fuel power and while new clean energy installations are hitting record levels, the step-up and speed-up of building additional storage capacities is becoming even more crucial to steadily supply reliable clean energy.

Forecasts for the growth of global energy storage range between 80GW and 88 GW of new installations per year7 . Despite the actual and predicted boost of storage capacities, an even larger quantity is needed to increase the reliability and uptime and overcome the intermittency of solar, wind and hydro energy. Therefore, additional investments along the whole energy-storage value chain are required to help putting the proportion of clean energy production and energy storage in balance and address the ever-increasing demand for energy storage solutions.

These investments would very probably fall on fertile ground. A recent analysis predicts that the global battery energy storage market is set to increase from USD 10.88 billion in 2022 to USD 31.20 billion by 2029, growing at a double-digit pace of 16.3% in the forecast period.8

Considering this staggering growth, directing financial flows to dedicated companies can offer various promising angles for investors: the well-funded research on novel performance-enhancing materials can speed up the development and marketability of pioneering energy collecting technologies. This, finally, could substantially shape the vital co-evolution of clean energy production and energy storage.

Storing Energy remains a giant undertaking over the coming years and is creating multiple investment opportunities. Several use cases need different forms best fitting their individual needs requiring different forms of technical solutions. This speaks to the broad opportunities and solutions through the entire value chain.

1 International Energy Agency: Renewable power’s growth is being turbocharged as countries seek to strengthen energy security. December 2022

2 Congress.gov: Energy Storage Tax Incentive and Deployment Act of 2021. September 2021

3 New York State: Types of Energy Storage

4 American Clean Power Market Report 2022, May 2023

5 Digitaljournal.com: Latin America Solar Energy Storage Market Shows Robust Growth Potential

6 EU Commission recommendation on Energy Storage – Underpinning a decarbonised and secure EU energy system. 14 March 2023

7 Bloomberg NEF: 1H 2023 Energy Storage Market Outlook. March, 2023 and International Energy Agency: Grid-Scale Storage. September 2022

8 Fortunebusinessinsights.com: Global battery energy storage market. March 2022