Achieving Sustainability

Sustainable investing: five themes for 2024

Pragmatism is the watchword as we look forward to the topics that may shape sustainable investing in the new year. Here are the five themes to watch.

Key takeaways

- As attention turns to 2024, we welcome a pragmatic, risk-based approach to addressing critical sustainability-related challenges.

- Against a backdrop of global instability, the frequency of damaging weather-related events will continue to remind the world that climate is a topic with near-term impact.

- High-quality, innovative data capture increasingly allows for a robust quantification of risks that underpins ESG 2.0.

- The topic of transition will be an increasing focus, including from regulators.

1. The political agenda could pack a “delayed” punch

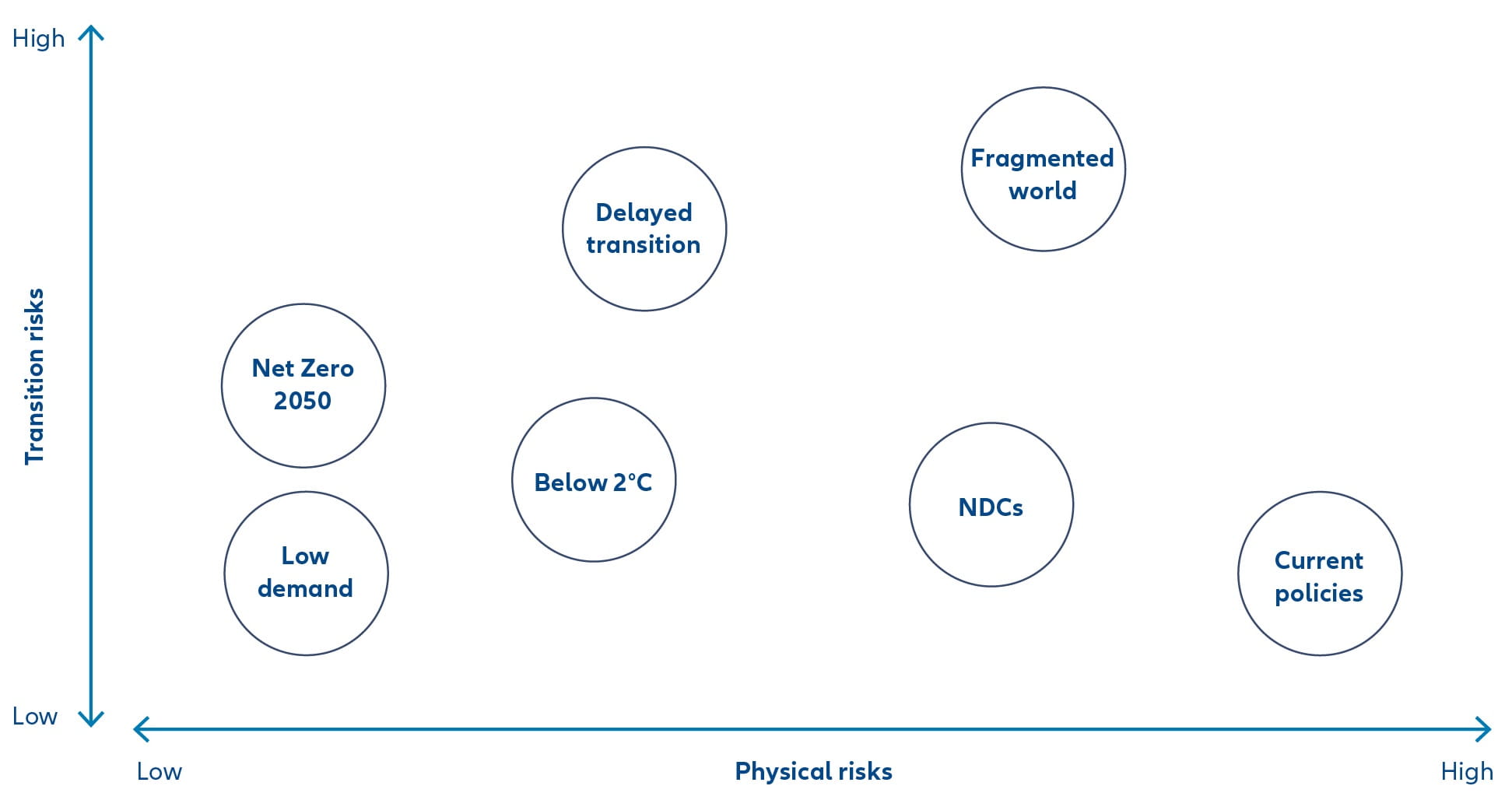

Network for Greening the Financial System (NGFS) scenario analysis

Source: NGFS Scenarios Portal, https://www.ngfs.net/ngfs-scenarios-portal/explore/, November 2023

See portal for more explanation of the different scenarios.

2. From climate change to climate impact

3. ESG is dead, long live ESG 2.0

4. From the transition of regulation to the regulation of transition

5. Finding a solution with impact

1 Bloomberg, November 2023

2 NGFS – Network for Greening the Financial System, November 2023

3 International Monetary Fund, October 2022

4 International Monetary Fund, August 2023

5 Health is wealth?, Allianz Global Investors, October 2023

6 The rules of engagement to protect biodiversity, Allianz Global Investors, June 2023

7 UN Environment Programme Finance Initiative, 2004

8 CFA Institute, August 2021

9 ASEAN Taxonomy for Sustainable Finance, November 2023

10 OECD, November 2023

11 Glasgow Financial Alliance for Net Zero, September 2023

12 UN Climate Change, July 2023

13 International Institute for Sustainable Development, December 2022

14 Investing for meaningful impact in private markets, Allianz Global Investors, July 2023