Allianz Global Intelligent Cities invests in companies whose products and services are benefitting from the smart cities trend and are helping to build a better future through innovation.

Why Allianz Global Intelligent Cities?

-

Capturing growth from the smart cities trend

Urbanisation and technological innovation are two of the four key megatrends that we identify as having the greatest impact on our future. Population growth is forcing city planners to think smarter. A thematic investing lens provides a way to capture this secular global growth opportunity. -

A broad & diversified global opportunity set

More than 80% of global GDP comes from the world’s cities but they are facing numerous challenges as they grow. It is estimated that by 2026, over USD 3 trillion may be spent on modernising our cities with intelligent solutions across industries.1 -

Attractive income & total return solution

The fund invests across the capital structure of innovative companies using a unique multi-asset approach. The goal is to provide investors with a stable income stream and attractive equity market exposure- with less volatility than a pure equity strategy.2

By 2026 the market opportunity for intelligent city ecosystem could reach over...

Intelligent cities use technology and innovation to..

-

create efficiencies

-

improve sustainability

-

promote economic development

-

enhance quality of life factors for people living and working in the city

.. in order to deal with the challenges cities face

More than 80% of global GDP1 comes from the world’s cities but with increasing populations, their inhabitants are facing numerous challenges.

Pollution

Crime & Safety

Traffic

Public Services

Resource Scarcity

Cost of Living

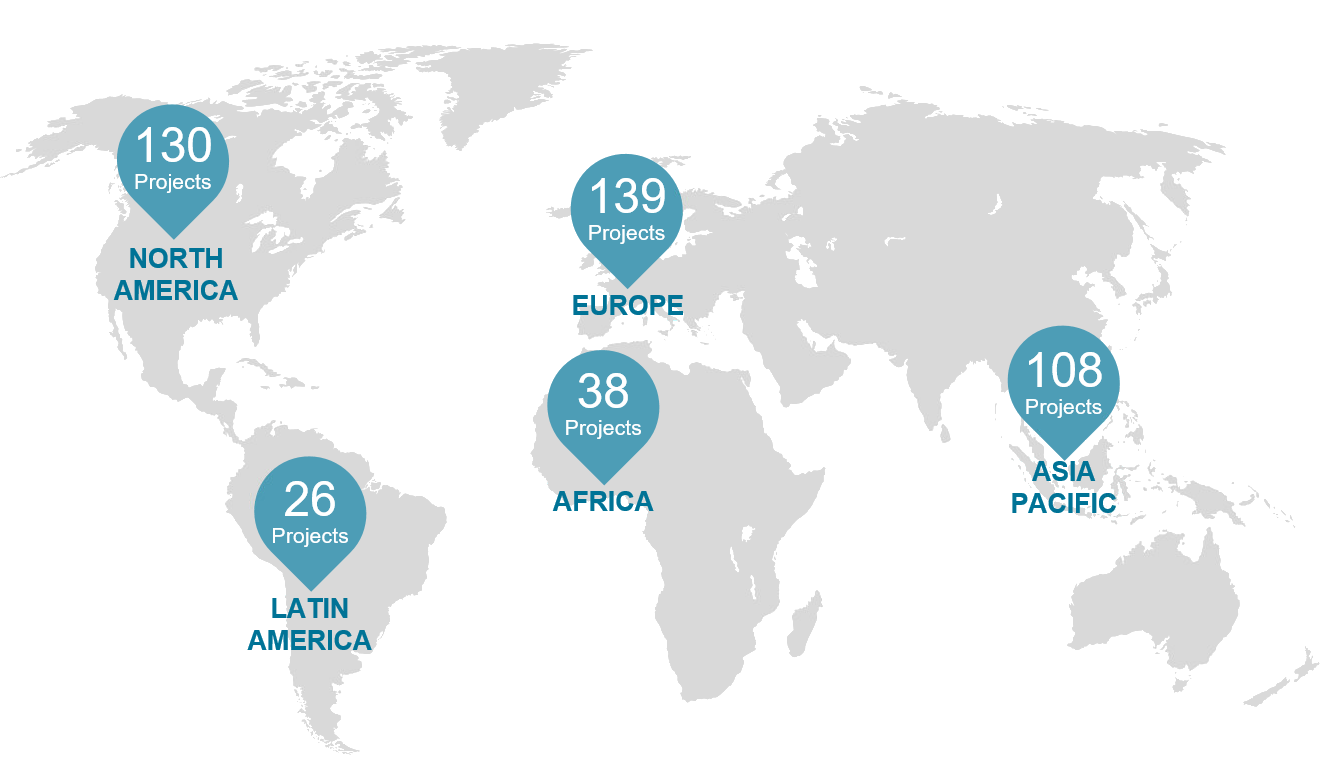

There is a broad opportunity set of smart cities globally³

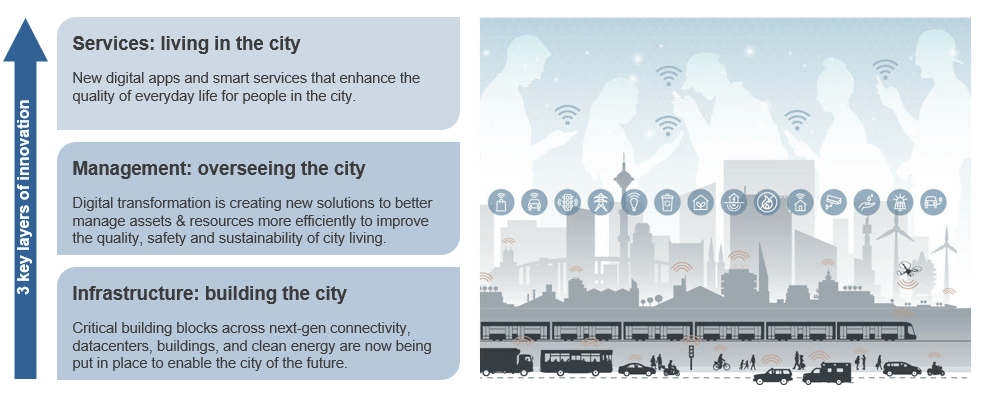

We invest across the intelligent cities’ ecosystem

Capturing this opportunity requires insight into how technological innovation and convergence can create an impact on our daily lives. We use a distinct multi-asset approach to invest across a company’s capital structure with the goal of providing a stable income stream and attractive equity market exposure with less portfolio volatility than a pure equity strategy. We identify key themes within these areas of innovation, e.g., software and services, safety and security, smart home, sharing, infrastructure, buildings, clean energy and mobility.

An experienced and well-connected team

Capturing this opportunity requires insight into how technology convergence can create impact.

Our Global Intelligent Cities strategy combines experts from the Global Artificial Intelligence and Income & Growth teams.

Stephen Jue

Portfolio Manager,

Global AI Strategies

James Chen, CFA

Portfolio Manager,

Global AI Strategies

Justin Kass

Portfolio Manager,

Income & Growth Strategies

David Oberto

Portfolio Manager,

Income & Growth Strategies

Allianz Global Investors and Voya Investment Management have entered into a long-term strategic partnership, and as such, as of 25 July 2022, the investment team has transferred to Voya Investment Management. This will not change the composition of the team, the investment philosophy nor the investment process. Please note the corporate and functional titles for the investment team are the current AllianzGI titles.

|

01/10/2021

|

||

|

01/10/2021

|

Sources:

1 Persistence Market Research 2017. https://www.persistencemarketresearch.com/mediarelease/smart-cities-market.asp.

2 Performance of a strategy is not guaranteed and losses remain possible

3 Navigant Research Q2 2019

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested. Allianz Global Intelligent Cities is a sub-fund of Allianz Global Investors Fund SICAV, an open-ended investment company with variable share capital organised under the laws of Luxembourg. The value of the units/shares which belong to the Unit/Share Classes of the Sub-Fund that are not denominated in the base currency may be subject to a strongly increased volatility. The volatility of other Unit/Share Classes may be different. Past performance does not predict future returns. If the currency in which the past performance is displayed differs from the currency of the country in which the investor resides, then the investor should be aware that due to the exchange rate fluctuations the performance shown may be higher or lower if converted into the investor’s local currency. This is for information only and not to be construed as a solicitation or an invitation to make an offer, to conclude a contract, or to buy or sell any securities. The products or securities described herein may not be available for sale in all jurisdictions or to certain categories of investors. This is for distribution only as permitted by applicable law and in particular not available to residents and/or nationals of the USA. The investment opportunities described herein do not take into account the specific investment objectives, financial situation, knowledge, experience or specific needs of any particular person and are not guaranteed. The Management Company may decide to terminate the arrangements made for the marketing of its collective investment undertakings in accordance with applicable de-notification regulation. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer companies at the time of publication. The data used is derived from various sources, and assumed to be correct and reliable at the time of publication. The conditions of any underlying offer or contract that may have been, or will be, made or concluded, shall prevail. The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted; except for the case of explicit permission by Allianz Global Investors GmbH.

For investors in Europe (excluding Switzerland)

For a free copy of the sales prospectus, incorporation documents, daily fund prices, key investor information, latest annual and semi-annual financial reports, contact the issuer at the address indicated below or www.allianzgi-regulatory.eu. Austrian investors may also contact the facility and information agent Erste Bank der österreichischen Sparkassen AG, Am Belvedere 1, AT-1100 Wien. Please read these documents, which are solely binding, carefully before investing. This is a marketing communication issued by Allianz Global Investors GmbH, www.allianzgi.com, an investment company with limited liability, incorporated in Germany, with its registered office at Bockenheimer Landstrasse 42-44, 60323 Frankfurt/M, registered with the local court Frankfurt/M under HRB 9340, authorised by Bundesanstalt für Finanzdienstleistungsaufsicht (www.bafin.de). Allianz Global Investors GmbH has established branches in the United Kingdom, France, Italy, Spain, Luxembourg, Sweden, Belgium and the Netherlands. Contact details and information on the local regulation are available here (www.allianzgi.com/Info). The Summary of Investor Rights is available in English, French, German, Italian and Spanish at https://regulatory.allianzgi.com/en/investors-rights.

For investors in Switzerland

For a free copy of the sales prospectus, incorporation documents, daily fund prices, key investor information, latest annual and semi-annual financial reports, contact [the Swiss funds’ representative and paying agent BNP Paribas Securities Services, Paris, Zurich branch, Selnaustrasse 16, CH-8002 Zürich - for Swiss retail investors only] or the issuer either electronically or by mail at the given address. Please read these documents, which are solely binding, carefully before investing. This is a marketing communication issued by Allianz Global Investors (Schweiz) AG, a 100% subsidiary of Allianz Global Investors GmbH. The Summary of Investor Rights is available in English, French, German, Italian and Spanish at https://regulatory.allianzgi.com/en/investors-rights.