25 Years Best Styles – an investment and business success story

When the Best Styles franchise was launched in 1999, not everyone was convinced of the simple but bold idea of taking academic financial markets research and turning it into an investment strategy. A lot of work had gone into the proposal as approaches for different investment styles – such as a value strategy and a trend-following strategy for global and European equity markets – were developed in the previous years. However, it was realized that each approach had its own drawbacks, and so the idea to add a quality component and find the best combination of all of them was born.

Key takeaways

- Best Styles was launched in 1999, pioneering factor investing by turning academic financial markets research into a proven investment strategy with a strong 25-year track record.

- Since Best Styles’ inception, research has been one of its key pillars and decisive driver. The application and integration of artificial intelligence (AI) techniques have been an important part of the investment process for over a decade.

- The incorporation of sustainable investing criteria and the development of dedicated Sustainable and Responsible Investing (SRI) strategies have grown in importance.

- The team is composed of members with strong and diverse academic credentials, and long-term industry experience.

As, at the time, there was no established terminology in the financial industry for this approach, it was coined “Best Styles” – something that would today be called a multifactor strategy. The team was a true pioneer in factor investing without calling it by its name.

Today the Systematic Equity team can proudly look back at one of the longest global equity track records of any systematic investor. And, remarkably, the broad framework of the strategy has remained consistent over the years, making this history even more relevant for investors today. This also shows the resilience and conviction of the team, which has experienced much success over 25 years but has also overcome many challenges, not least the so-called “factor winter” period of 2018-2020, a period when the vast majority of factors underperformed.

At present, the Best Styles Global Equity strategy is the team’s flagship strategy with not only the longest track record but also the largest assets; variations of this strategy make up more than half of the assets that the Systematic Equity team currently manages on behalf of clients. The remarkable track record reflects consistent and stable outperformance, resilient to varying economic and market cycles.

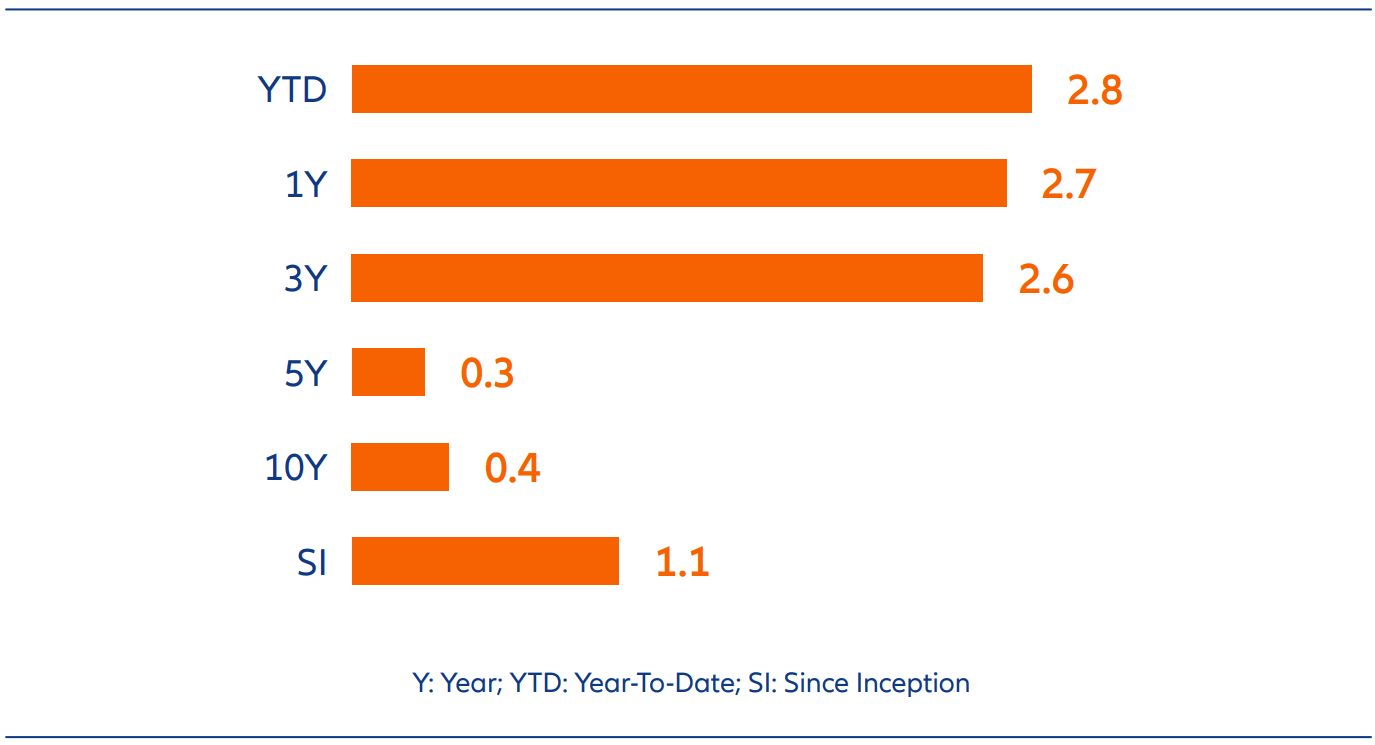

AllianzGI Best Styles Global Developed Equity Composite – active returns (in %) Benchmark: MSCI World, Inception: 01/01/1999

Past performance does not predict future returns. Source: IDS as of 30/11/2023, in EUR, gross of fees. AllianzGI Best Styles Global Developed Composite performance inception date: January 1, 1999. Benchmark: MSCI World.

The performance shown above is gross and does not reflect the deduction of investment advisory fees.

Best Styles was launched in 1999 in a Global Equity mandate seeded by an external client. Its track record demonstrates the power of compounding stable outperformance and stresses the benefits from preventing drawdowns in relative performance. Over time, the strategy has delivered on its promises, delivering strong risk-adjusted returns, achieving a high information ratio of 0.6 due to the low tracking error of 1.7%1 . The strategy invests in a well-diversified mix of the five longterm investment styles, enhanced by Artificial Intelligence, it aims to achieve high alpha potential and harvest risk premia. Over time, each style has been a proven driver of longterm equity portfolio performance2 .

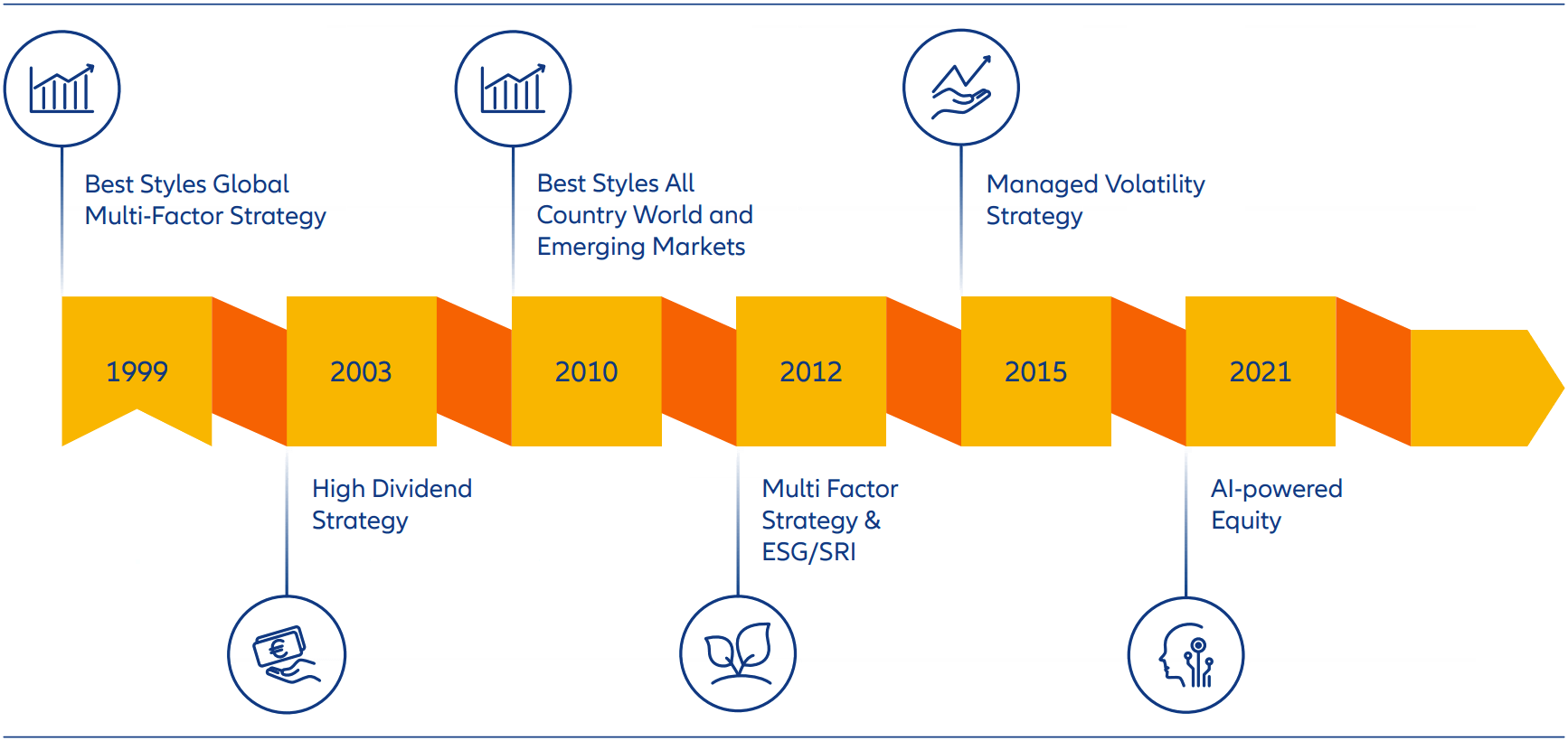

Milestones and major steps

25 years of investment strategy development by the Systematic Equity team

Source: AllianzGI. As of December 2023. For illustrative purposes only.

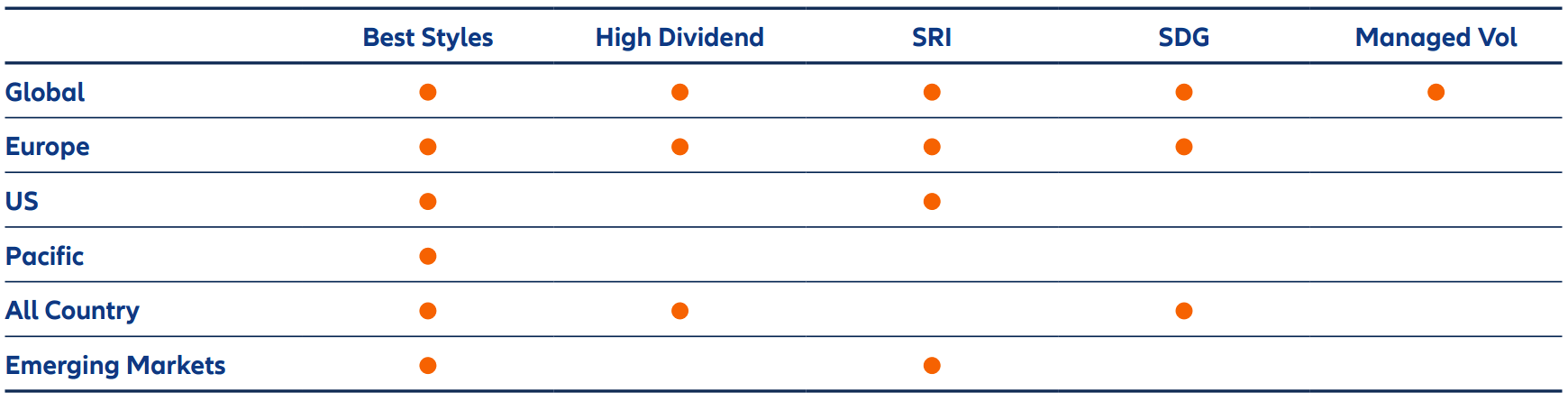

After launching Best Styles Global equity, the next step on the journey to becoming a major part of Allianz Global Investor’s Equity franchise was a natural one for a European asset manager: launching a Best Styles European Equity and a Best Styles Euroland Equity version in 2001. These strategies have become the second largest pilar for the team, and their long-term track record is on par with the flagship Global Equity strategy. The offering was complemented in 2010 by a Best Styles Global All Country strategy, including investments in emerging markets, and by a dedicated Emerging Markets Equity strategy in 2011. This was followed by the launch of Best Styles US equity in 2012.

With the launch of the first dividend-focused strategy in 2003, for European Equity, the team began to diversify its investment offering in a different way. Taking other investment objective into account – such as generating income through dividends – added another dimension to the approach. This required significant research and ultimately became a success story of its own, including the launch of a Global High Dividend strategy in 2011 which has gone from strength to strength.

More recent developments include a Managed Volatility strategy in 2015. This strategy aims for outperform a minimum volatility portfolio by managing investment style exposure based on the experience with Best Styles.

And finally, in 2021 the team launched a range of funds solely powered by the application of artificial intelligence techniques which were developed over the past decade.

A sustainability success story

Another milestone had its origins in 2012 when the team began to engage with the first clients on incorporating sustainable investing criteria into the management of their portfolios.

The team thus developed dedicated SRI (Sustainable and Responsible Investing) strategies that broadly apply the sustainable investing toolkit, from additional SRI exclusions over Best-in-Class SRI selection, to portfolio level SRI targets and SRI benchmarks.

This culminated in the launch of SRI strategies in 2014 and a range of dedicated SRI mutual funds in 2019.

The sustainable investments story does not end there. In 2023 the team added a new fund to its offering, aligned with the United Nations Sustainable Development Goals (SDGs)3. As a contribution to dealing with the pressing topic of global warming, the team also more recently developed a Climate Change investment strategy – now ready to launch – aligning investments with the need to decarbonize the economy.

The Systematic Equity team have thus garnered a wealth of experience in the incorporation and management of multi-factor strategies with a focus on sustainability. They now manage investment strategies with sustainability feature in portfolios accounting for more than a third of the team’s assets under management.

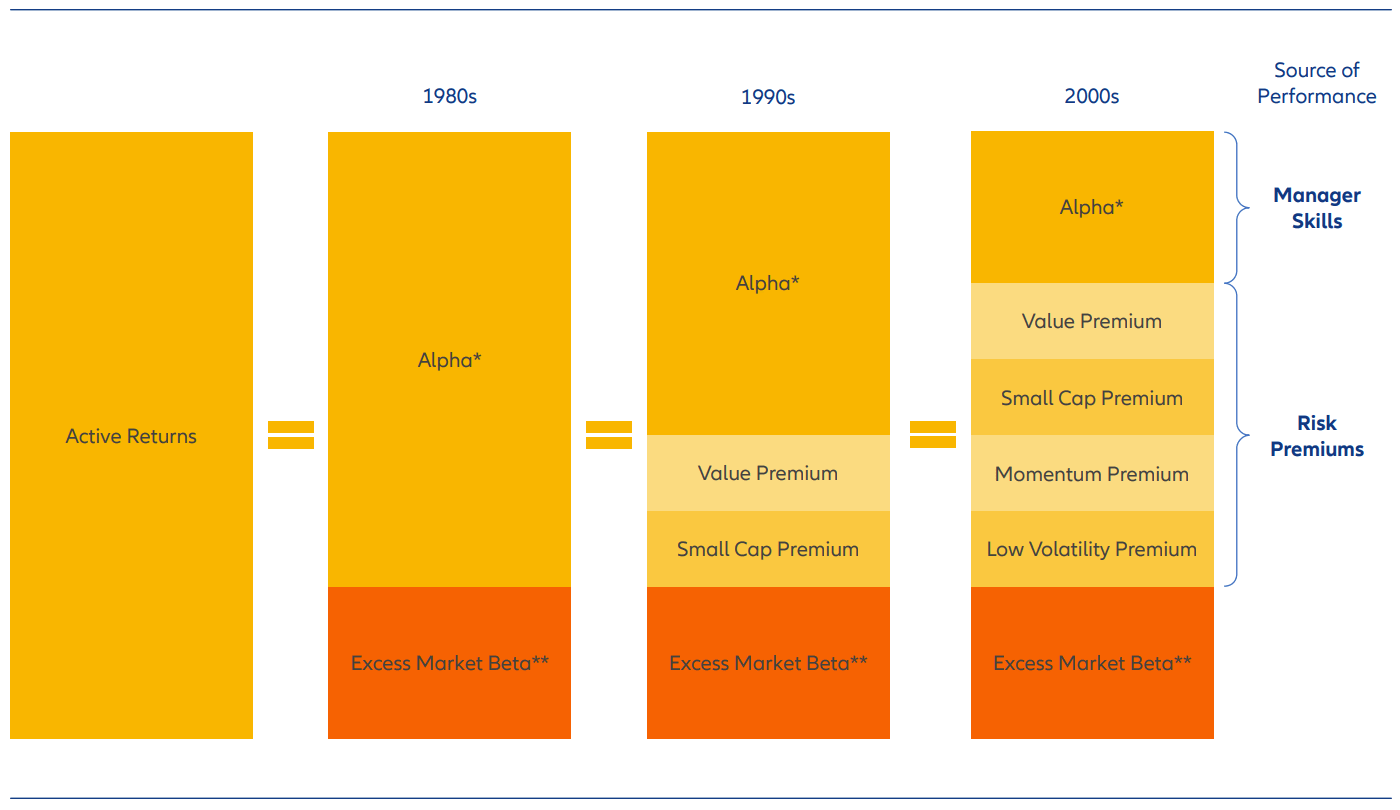

Research, a forward-looking foundation

The understanding of equity market returns has significantly improved over the decades

* Alpha – A term used to describe an investment strategy’s ability to outperform the market.

** Market Beta – a measure of stock volatility in relation to the overall market.

Source: MSCI and Allianz Global Investors. As of December 2023.

Glossary of Investment Styles

| Value | “Cheap” stocks with attractive valuations, often “out of favour” or “contrarian”. Inputs: Price/Earnings, Price/Book, Dividend Yield, … |

| Momentum | Stocks with strong recent performance, with a positive trend or “in favour”. Inputs: Deep Learning Momentum, Price Momentum, Relative Strength, … |

| Revisions | Stocks of companies whose earnings have been positively revised by sell-side analysts. Inputs: Earnings Call Transcripts, Earnings Revisions, Earnings Surprise, … |

| Growth | Stocks with positive growth, especially a history of delivered, i.e. stable growth. Inputs: Earnings Growth, Dividend Growth, etc. |

| Quality | Financially strong stocks with high profitability, high balance sheet quality etc. |

| High Risk | Stocks with high return volatility or beta. |

| Small Cap | Stocks with lower market capitalization. |

However, academic research on financial markets alone does not always translate directly into implementable investment strategies. Research by practitioners is equally important and here the Systematic Equity team had a head-start with its early beginnings.

Since the origins of the Best Styles strategy in 1999, the Systematic Equity team has remained at the forefront of quantitative strategies, conducting their own research and enhancing their investment process. While the broad framework of styles and portfolio construction has remained consistent, the team found early on that there was room for improvements.

During the first years of managing the Best Styles strategy, the team realised that there were other influential factors – such as commodity prices – which are prone to large swings, taking market sentiment as well as stock prices with them. This can impact short-term performance while not adding value for investors over the long run. The team decided to conduct research on avoiding these risks and they ultimately came up with what is today a key differentiator of Best Styles: successfully managing what they call “non-rewarding risk factors”.

While the broad investment styles targeted have remained constant, much has changed under the hood. And while the team has enjoyed much success, they have also navigated market turmoil and overcome challenging periods – by constantly innovating, but also by sticking to their conviction in the foundations of the approach.

Embarking on the artificial intelligence journey

Thanks to the strong academic credentials of the team, they were able to embark on testing and applying a broad range of quantitative techniques, some of which today fall under the banner of AI. As such, the team has been active in applying AI techniques for over 10 years and, today, AI forms an integral part of the investment process. This includes areas such as machine learning, neutral networks, and natural language processing, which has now merged into large language models such as ChatGPT. In 2021 a framework on how to integrate AI signals in the Best Styles strategy was developed. Separately, a range of dedicated funds powered by this AI research was launched.

While AI is a very exciting field, other areas of research have not been neglected. The factor which has probably undergone most research and most change is “Quality” (while there is only some consensus in terms what this should comprise, there is generally a focus on profitability and other accounting measures). This is partly due to the extent of the academic research conducted over the years, but also the proprietary efforts by the team. And this effort is ongoing, with enhancements made in 2023 and more on the way.

Today Best Styles is a truly balanced and diversified multi-factor approach. The investment style “Value” still plays a significant role, but it has evolved and is even more complemented by “Quality” and a broader definition of trend-following styles than before. In combination with AI techniques, this makes for a compelling proposition and shows how research can help to retain an edge in the highly competitive asset management industry.

A diversified team with a distinctive expertise

In the first years after the Best Styles approach was launched at Allianz Global Investors, expertise around systematic equity investing was pooled in a small, dedicated team drawn from various areas of the firm. Ultimately, a handful of researchers and portfolio managers led the strategy and building the Best Styles franchise.

Some of the early team members have now gone into well-deserved retirement, but others with long tenure have stepped up or have joined the team. With its considerable number of PhDs, the team certainly has strong academic credentials, and diversity of thought has always been key to their success. As such, the team comprises members with backgrounds in finance and economics as well as engineering, mathematics, and physics, like Dr Michael Heldmann, CIO Systematic Equity, who was previously a researcher in the field of particle physics at the international laboratory CERN in Geneva, Switzerland. Many have long-term industry experience – the average is 14 years – and have been with the team for a long time – over eight years on average, but several have been with the team for 15 to 20 years. With 18 portfolio managers and researchers the team is a strong resource supporting an important franchise of Allianz Global Investors, and managing assets of around EUR 39bn in more than 170 portfolios on behalf of clients.

The team is today led by Michael Heldmann who joined in 2007. He has made significant contributions to the franchise and investment process, bringing with him techniques and insights from his academic work as a particle physicist at CERN, and has been instrumental in integrating AI techniques into the investment process, as well as developing a sustainable best-inclass addition to the strategy. As CIO Systematic Equity since 2021, he sets the research agenda that aims to take the team to the next level. Greater focus and accountability are part of this journey which has led to the establishment of dedicated research, led by Joerg Hofmann, and sustainable investment, led by Patrick Vosskamp, alongside the tenured portfolio management team.

Franchise

The early years of any investment strategy are always challenging as portfolio managers work to establish a track record and their rapport with clients, and this was not different for this team. Initially the effort concentrated on a small number of portfolios and establishing the team as reliable investors. However, the complementary nature of this strategy in terms of approach and performance outcomes, the strength of the firm’s client base and the launch of new variations of the strategy in collaboration with clients, helped quickly raise the first billion of assets. The innovative approach reflected the zeitgeist of the period, and strong performance during 2004 to 2006 put the strategy on a trajectory for further growth.

After the financial crises, a paper by several renowned academics ignited the interest in factor investing (Evaluation of Active Management of the Norwegian Government Pension Fund – Global, Andrew Ang, William N. Goetzmann, and Stephen M. Schaefer, December 2009), especially among large institutional asset owners. Their research concluded that most of the benefits from spreading investments across many different managers can be achieved by a systematic multi-factor approach – typically at lower cost. Exactly what the Best Styles strategy had already been delivering for several years.

At the same time, much talk in the investment industry was about “Smart Beta”, a concept that promised to give retail investors, in particular, access to the insights gained over many years of factor research. This further broadened interest in systematic equity investing and thus also the Best Styles approach.

In the following years, assets managed by the Systematic Equity team grew from over EUR 8bn in 2011 to over EUR 35bn in 2022, and close to EUR 40bn now. It remains an important growth area for Allianz Global Investors.

Convincing performance: Batting Averages – percentage of periods of out- or underperformance for rolling periods across 25 years of live composite performance history

Past performance does not predict future returns. Source: IDS as of 31/10/2023, in USD, gross of fees.

AllianzGI Best Styles Global Developed Composite performance inception date: January 1, 1999. The performance shown above is gross and does not reflect the deduction of investment advisory fees.

Rolling 5-year returns are supplemental information and supplement the AllianzGI Best Styles Global Developed Equity GIPS compliant composite presentation.

25 successful years and counting

Looking ahead, it’s a given that the team will continue to refine their approach to styles and factors. They recently implemented enhancements to the factors underlying some of the investment styles, helping to further improve the risk/return profiles for clients in the future. To continue generating sustained outperformance going forward, the team is set to expand and refine its analysis of the ever-growing data universe, enhancing the investment processes by embracing technology such as AI and machine learning to analyse data more thoroughly and exploit information not yet revealed by the market.

The team is well-positioned to take advantage of technological developments and the renewed tailwinds for systematic equity investing, building on their extensive track record and staying true to the investment philosophy and approach. It is an exciting time for systematic equity investing and the team is ready to make the most of it.

Main Systematic Equity strategies

Source: AllianzGI. As of December 2023. This is for guidance only and not indicative of future allocation.

1 Tracking error is a measure of volatility of excess returns over a benchmark. Information Ratio is a risk-adjusted measure of excess returns over a benchmark, dividing excess returns by their tracking error.

2 The performance of the strategy is not guaranteed and losses remain possible. Past performance does not predict future returns.

3 Sustainable Development Goals, United Nations 2015. AllianzGI supports Sustainable Development Goals (SDGs).