Pet longevity: lengthening the life span of our furry companions

With ever-aging pets, investements in innovators that help protect pets’ quality of life can offer opportunities to participate in pet care market's growth.

Key takeaways

- In the last years, the life expectancy of pets has significantly increased, mainly driven by a shift to high-quality food, a human-like care, an increasing adoption of preventive diagnostics and a greater awareness for regular vet visits

- With an extended live expectancy of pets, the demand for pet food, medicine, vaccines and supplements that address special nutritional needs and preventive care requirements of pets is constantly growing

- Investments in innovators that help prolong, improve, and protect pets’ quality of life can offer attractive opportunities to participate in the growing pet health and pet care market

Bobi, a 30-year-old livestock guardian dog (purebred Rafeiro do Alentejo), is currently the world’s oldest dog1. Normally, Rafeiro do Alentejos have an average life expectancy of 12-14 years.

With 27 years of age, Flossie is presently the oldest cat living2, far exceeding felines’ average life span of roughly 15 years.

Although Bobi and Flossie are both clearly exceptional, there is an evident trend towards an ever-increasing average lifespan of pets.

Research found that in the past four decades, dog life expectancy has nearly doubled while housecats now live twice as long as their feral counterparts, mainly ascribed to better health care and better diet.3

Studies for the US show that the number of households with senior dogs and cats has considerably augmented within the last decade.

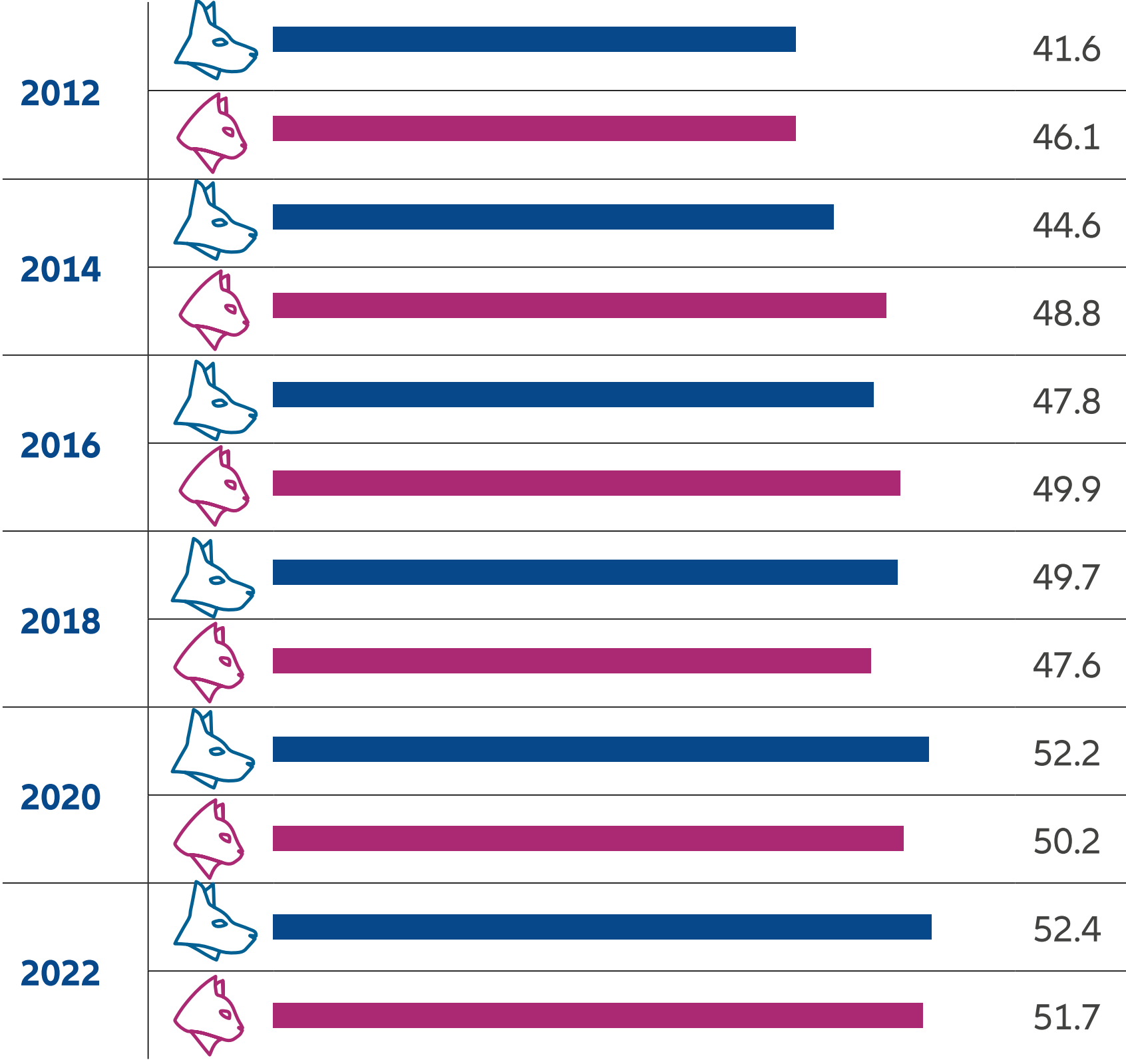

Share of dog/cat-owning households with senior pets aged 7+ (%, period 2012-2022)

Source: Packaged Facts, Pet Food in the US (August 2022); MRI-Simmons

Consequently, nutritional assessments to create individual nutrient profiles and appropriate diets especially for elder pets are moving into the centre of pet parents and veterinary practices. For good reasons, considering that around one-third of cats older than 12 years have decreased fat digestibility and about a fifth of cats greater than 14 years show reduced protein digestibility.4

What are the most important drivers supporting pets’ longevity?

Looking at nowadays’ prolonged lifespan of pets, we can broadly identify three main drivers that support a longer and healthier life of our furry companions.

1. From pet owners to pet parents: a shift in paradigm

In the last years there has been a noticeable change in the self-conception of pet owners gradually transforming into pet parents.5

Within this transformational process, pet parents have become increasingly inclined to spend more on a healthier, wholesome nutrition, on preventive care, on more frequent vet visits and on insurances specifically tailored to different stages of their pets’ life.

According to our GRASSROOTS RESEARCH® findings:

- 69% of US pet owners would increase their veterinarian expenses if it were necessary to extend their pet’s life6

- 46% of European pet parents pay a premium price for pet food to improve their pet’s nutrition7 while between 35% and 40% are considering paying a premium for higher quality food.

Other studies found that the number of insured pets in North America rose from 4.4 million in 2021 to 5.36 million in 2022, representing an average annual growth rate of 21.7%.8 Pet owners that have pet insurance are least likely to worry about vet costs and presumably more disposed to visit veterinarian more often for regular check-up and medical treatment. An increasing rate of insurance adoption contributes positively to the growth in pet care industry.

A leading pet insurance company has created an over-the-counter (OTC) settlement system which allows policy-holding pet parents to pay only uncovered sums out of pocket, by presenting their insurance card at the veterinary clinic/practice. With its OTC settlement, the firm wants to help remove financial concerns of vet visits, whle in parallel, significantly decreasing administrative costs. The corporate also provides telephone consultancy and pet parents educational services aiming for a better understanding of pets and for preventing serious diseases.

2. The key lies in high quality

More and more pet parents are shifting to high-quality food and to more sustainable pet products projecting their own preferences for a more healthy, wholesome, and age-appropriate nutrition on their pets. Consequently, the market and the product range for supplements and food that address special nutritional needs not least of senior and geriatric pets are experiencing a continuous growth.

Pet food – most important factors

When buying pet food, the most important factors are nutritional/ health benefits and pet preference, while the least important factor is veterinarian recommendation

When you buy food for your pet, which factors are most important to you? Please rank the following from 1 (most) to 6 (least)

Source: AllianzGI Grassroots Research®, October 2021

3. Faster and more efficient clinical decision-making

In parallel to adapting diets to the special nutritional needs of senior pets, regular diagnostic tests, preventive care, and comprehensive pet profiles are doing their part to support pets’ longevity. In conjunction, these solutions can help finding earlier indications to preventively intervene for chronic and age-related diseases, facilitating timely suitable medical treatments.

A worldwide active manufacturer of veterinary diagnostic software and services, offers solutions that support veterinarians creating comprehensive wellness profiles, allowing early clinical detection of abnormalities. Patient-specific, client-friendly diagnoses help to further educate pet parents and support individual diets and vet visits that are tailored to the specific pet patient history.

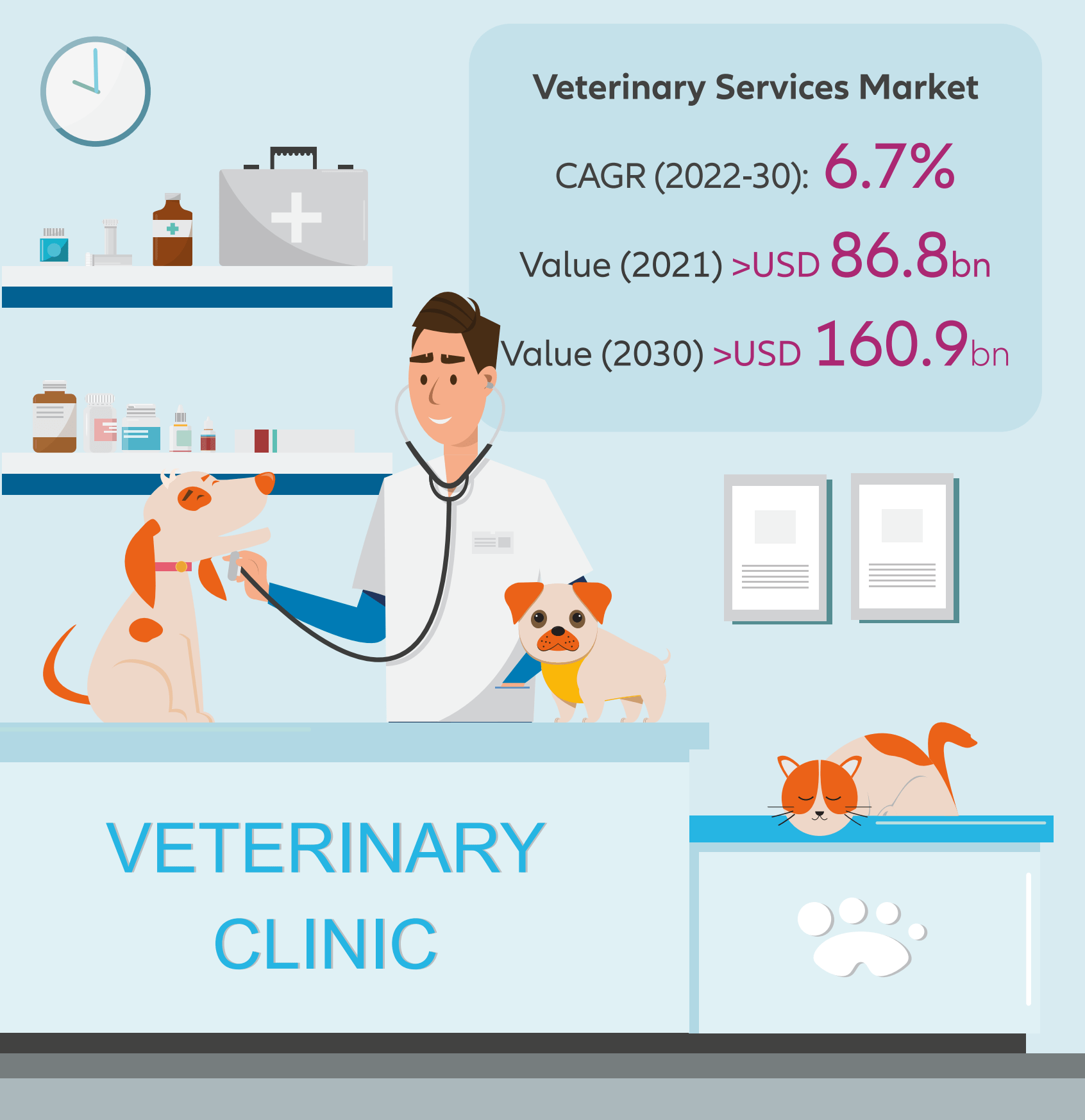

With the increasing sophistication and innovation of veterinary services comes the growth of the veterinary services supported by lower development costs and shorter development times for veterinary drugs. In parallel, a spreading awareness of preventive care and that vaccines are important both for maintaining animal health and preventing zoonoses transfers from pets can be identified as another driver of the market’s expansion.

Source: Global Market Insights: Veterinary Services Market, June 2022

The importance of vaccines is underpinned by recent estimates stating that 60% of infectious diseases and up to 75% of emerging infectious diseases are of zoonotic origin.9

Positive impact of pet longevity on human wellbeing

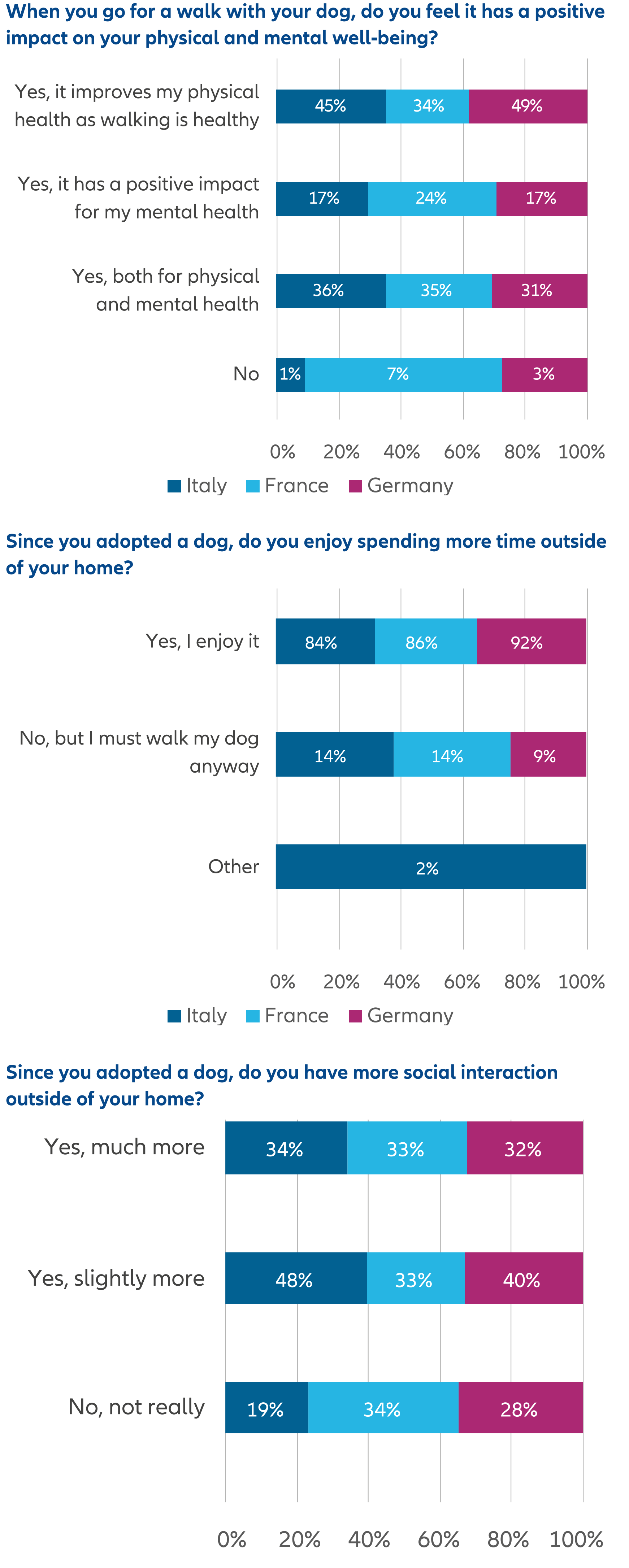

The benefits of human interaction with pets are an interesting and yet not sufficiently explored research object. However, our surveys with European dog parents show that adopting a dog can contribute to improve physical and mental health as well as support social interactions. Spending more time outside on fresh air and walking are more likely to have a positive contribution of the human overall wellbeing.

Source: AllianzGI Grassroots Research®, October 2021

Investment implications

Despite a current challenging market environment and volatility, we continue to believe that the pet economy is a solid long-term theme with several positive drivers, and companies in which we invest should benefit from these positive trends over time:

- From treating to preventingThe transition from treating pet diseases to preventing them could be a decisive driver for the growth of AIbacked preventive care and the digitalisation of clinical treatments. More people nowadays work more from home as they did before pandemic. Staying more at home with flexible work arrangement allows pet owners spend more time with their pets, perhaps noticing more health issues and going to vet more often for regular health check-up.

- Pet economy’s resilience to inflationary pressuresThe resilience of needs-based and demand-driven product categories such as pet food and healthcare to inflationary pressures. Higher inflation rates could be another factor in favour of pet economy’s long-term growth. Providers of pet products and services might be in a more favourable position to raise prices to pass on the cost increases to the pet owners, which results in higher pricing power. Several companies in PAW portfolio have demonstrated during high-inflationary environment in 2022 as having significant pricing power especially when it comes to pet care products.

- DemographicsAn ageing populations and healthy living are fuelling an existing wave of pet enthusiasts. With a growing middle class, particularly in emerging markets, pet ownership is increasing along with the level of care pets receive.

In economies such as China, the pet market is expected to triple in size by 202410. Over 50% of the country’s pet owners are Millennials or Gen Z (born after 1990). Within these groups pricing power can be even more pronounce as China’s Gen Z is less price-sensitive and more inclined to purchase high-quality products11. The demographics-driven growth potential of China’s pet economy is also reflected by a not yet saturated market: over 60% of the younger generation plan to keep pets in the future while less than 10% already have one.12

1 Guinnessworldrecords.com: Oldest dog ever record broken

2 Guinnessworldrecords.com: Oldest cat living

3 Science.org: A dog that lives 300 years? Solving the mysteries of aging in our pets. December, 2015

4 Sciencedirect.com: Senior Pet Nutrition and Management. March 2021

5 AllianzGI/Grassroots Research®, October 2021

6 Survey of pet owners in the US 2018

7 AllianzGI Grassroots Research®, October 2021.

8 North American Pet Health Insurance Association (NAPHIA). May 2023

9 Council on Foreign Relations: The Global Governance of Emerging Zoonotic Diseases. February 2023

10 PWC China, 2020

11 Jefferies Thematic Research Gen Z: Global Purchasing Power and Influence, August 2022

12 Ibid.