Sustainability data: turning the tide

A strong proprietary ESG1 data architecture is the cornerstone in understanding and aligning sustainable outcomes alongside financial returns. The challenge is to turn the mass of available sustainability data into insights that make an actionable difference.

Key takeaways

- Integrating non-financial factors into investment decisions is increasingly mainstream, but the choice and style of integration is still evolving.

- We think a dedicated ESG data strategy is critical for global asset managers to meet current and future data, portfolio scoping and reporting needs.

- Our dedicated Sustainability Methodologies and Analytics team strategically addresses the challenges of data selection, aggregation and implementation across public and private asset classes.

- Our new Sustainability Insights Engine – or SusIE – is a proprietary data tool to enhance understanding of ESG data.

Recent years have witnessed significant growth and change around the topic of environmental, social and governance (ESG) investing within the asset management industry. Rising investor interest has combined with evolving regulatory perspectives on ESG integration and a forced rethink of sustainability investing in the wake of the pandemic and geopolitical shocks. But the industry has yet to address the best way to handle the availability and application of sustainability data.

Without a dedicated and thoughtful approach to ESG data management, we think asset managers risk being overwhelmed. At Allianz Global Investors, we have a team dedicated to guiding investors through the current deluge of sustainability data including scores, ratings, key performance indicators (KPIs) and controversies – now that effective ESG data management has become a strategic necessity.

Everything everywhere all at once

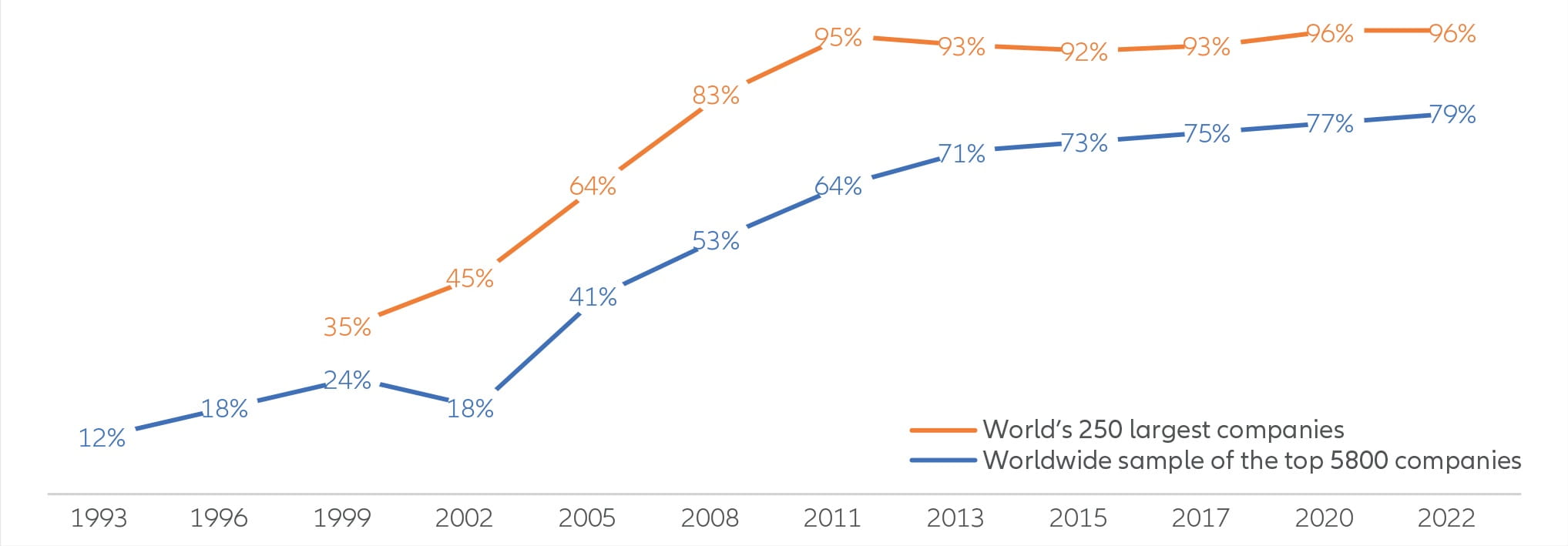

The growth in ESG disclosures in recent decades has been dramatic and now reached a point where most of the world’s largest companies report on sustainability (see Chart 1). This shift has been driven primarily by two factors: investor interest and regulation.

Companies have been able to address investor interest in sustainability or corporate social responsibility (CSR) reporting through frameworks provided by industry bodies like the Carbon Disclosure Project2 , the Global Reporting Initiative3 or the Sustainability Accounting Standards Board.4 These organisations have promoted and provided guidance on the most material ESG topics for public disclosure by corporations.

Exhibit 1: Global sustainability reporting rates, 1993-2022

Source: KPMG International5

The second and perhaps more visible driver has been the recent wave of regulatory initiatives hitting the capital markets. At continental and national levels, regulators have presented varying requirements for the disclosure of sustainability information from corporates. An example is the European Commission’s Principal Adverse Impact (PAI) framework, which requires specific indicators and methodologies to allow comparative analysis on potentially harmful investments.5 We anticipate this regulatory evolution to continue, especially outside Continental Europe.

We expect the company coverage and extent of ESG disclosures to expand significantly in the coming years. For example, climate reporting is expanding from Scope 1 and 2 emissions to a far wider scope of factors including Scope 37, methane, carbon offsets and even governance. The expanded disclosures will help on quantifying topics like net zero, taxonomy alignment and sustainable investment share8 . As more information is presented, all stakeholders will have to refine and adapt to ensure they are not paralysed by unhelpful analysis.

Too much of a good thing?

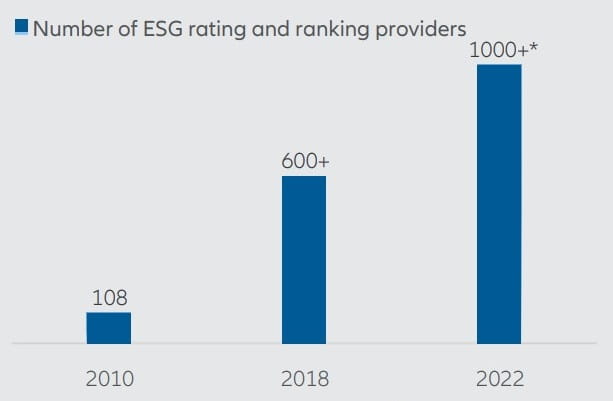

Investors are already struggling with the current scale of sustainability data, which is not necessarily helped by the multiplication of sources and methodologies – we expect both to escalate exponentially in the coming years. The main challenge derives from the population of data from ever-expanding and unregulated data providers that we estimate has exceeded a thousand now (see Chart 2). This translates into different standards on data capture, interpretation, methodology and delivery populating varying outputs for risk, sustainability, impact or controversy measures.

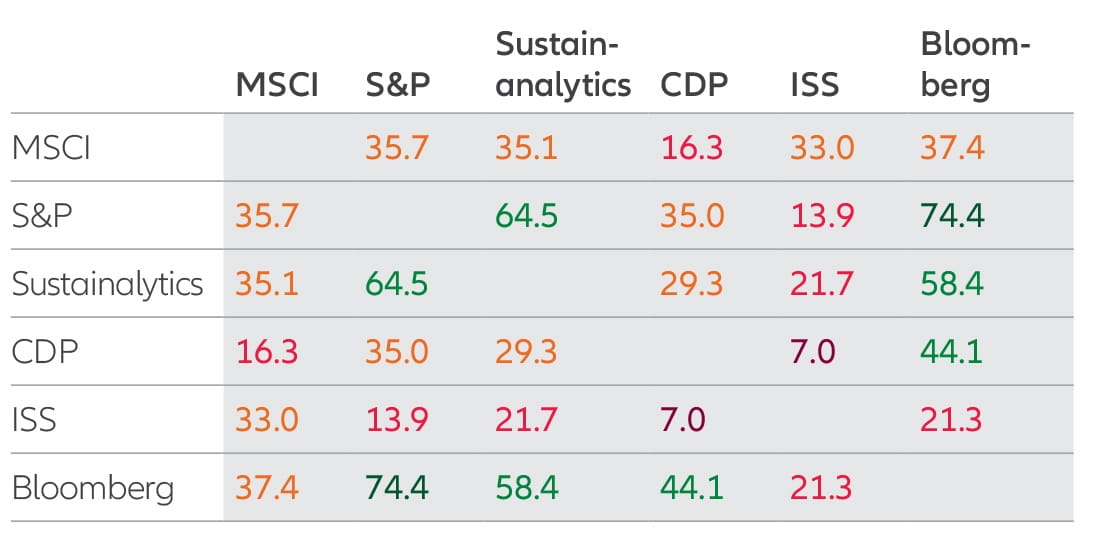

We are now able to measure our frustration at this complexity and lack of uniformity. While the correlations of outputs from the more mature financial credit ratings providers are at least 94%9, the ratings from the large ESG data providers exhibit lower and more disparate correlation – as highlighted by the CFA Institute in 2021 (see Chart 3).

Exhibit 2: Growth of ESG ratings and rankings providers

Source: Allianz Global Investors *projected figure

Exhibit 3: Correlation of ESG ratings (%)

Source: CFA Institute10

Meet SusIE – a dedicated sustainability data platform

While it took the finance industry several decades to come together on International Financial Reporting Standards, we are trying to achieve the same for nonfinancial standards in a fraction of the time. At AllianzGI, we believe sustainability requires a very specific and dedicated data approach to selection and aggregation.

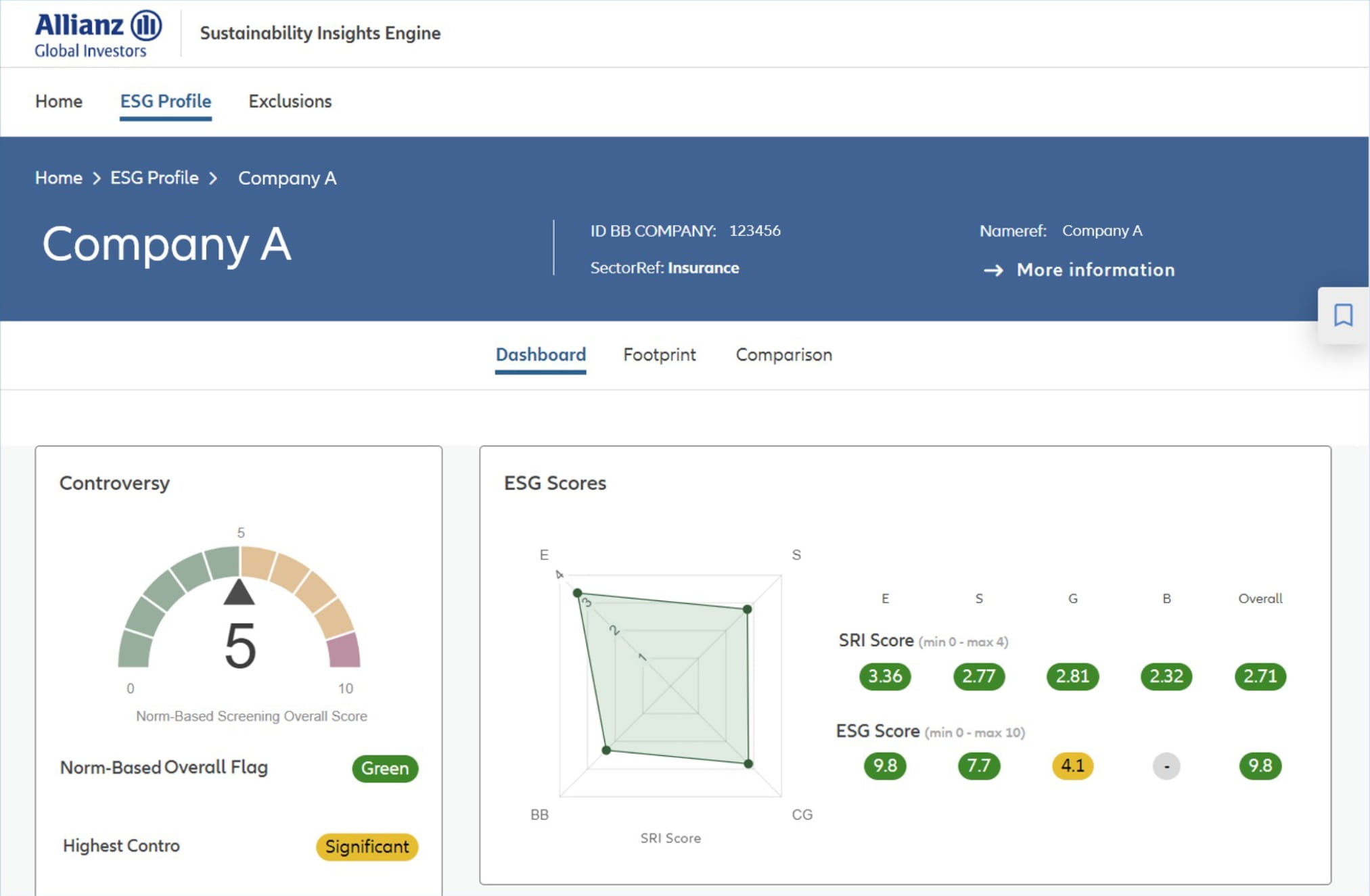

As such, we put in place the Sustainability Methodologies and Analytics team in 2021 to develop a transparent, robust, and digital architecture. Now launched, this architecture is known as SusIE or our Sustainability Insights Engine.

SusIE will support the delivery of ESG, sustainability and impact data – with accompanying perspectives and opinions – to our investment professionals. It involves a robust approach to scoping data sources, efficient aggregation of this data, and the population of this data into clear and commercial front office-facing tools. SusIE is designed to support the introduction of new data, removal of redundant data, and alignment to new client product offerings. An example is the new net zero alignment toolkit, scheduled for launch later in 2023.

Exhibit 4: Example ESG profile from the AllianzGI SusIE showing Company A in the insurance sector

Image taken from SusIE dashboard showing ESG screening and controversy scores across several factors.

How we scope data for SusIE

We value the cognitive diversity of the different approaches in the market, and this helps us avoid unintended implicit biases in model outputs. But discipline is needed in how we treat the different sources, and we separate data providers into three broad categories11

- Generalist – these provide a full range offering of ESG services, including raw data, peer analysis, ESG scores and qualitative analysis on ESG factors.

- Specialist – a highly granular, specific or niche offering of data, opinions (eg, small cap, private markets) or themes (eg, biodiversity, social impact).

- Technology – providers using alternative data capture techniques like artificial intelligence or natural language processing to offer a new range of services and analytics. These can include forward-looking measures, fuller coverage of investable universes, news flow screens and truly independent raw data sets.

Positioned for an ESG technology-powered future

The one constant in any form of technology is change and we are readying ourselves for this. We currently identify three likely important elements of any evolution of data and how they can be embedded in a robust and resilient ESG data strategy:

- Evolving data capture away from current reliance on purchased data. New technologies will allow for more alternative and independent sources, capturing more perspectives. A likely future hybrid model will see quality raw data complemented by external expert opinions.

- Powerful engines and efficient data processing to address the volume of data. This includes cleansing, matching, computing, transforming and distributing separate sources into consistent, standardised data sets. More granular E, S and G metrics will inform investment decisions and asset allocation and meet client-reporting expectations.

- Risk assessments will benefit from new techniques. The scraping of formal reporting suites is now mainstream, but a fuller and more predictive understanding of material risks will be achieved through new technologies applied to an entity’s entire value chain. A fuller measure of idiosyncratic non-financial risks will allow for investment diversification of these risks.

Nothing artificial about the intelligence outlook

1 ESG = Environmental, Social and Governance

2 Carbon Disclosure Project – www.cdp.net/en

3 Global Reporting Initiative – www.globalreporting.org

4 Sustainability Accounting Standard Board – www.sasb.org

5 Source: KPMG Survey of Sustainability Reporting 2022, KPMG International, September 2022. Worldwide sample of the top 5800 companies represent a worldwide sample of the top 100 companies by revenue in 58 countries or jurisdictions, 5800 companies in total. World’s 250 largest companies represent the world’s 250 largest companies by revenue based on the 2021 Fortune 500 ranking

6 Another example is the EU Non-Financial Reporting Directive 2014/95/EU, as well as the proposed Corporate Sustainability Reporting Directive.

7 Scope 1,2,3 are different categories of greenhouse gas emissions, Scope 3 emissions cover those produced by customers using the company’s

products https://www.weforum.org/agenda/2022/09/scope-emissions-climate-greenhouse-business/

8 The share of a fund that is considered as sustainable according to the EU Sustainable Finance Disclosure Regulations definition

9 Study on long-term debt ratings from Standard & Poor’s, Moody’s, and Fitch Ratings of 400 companies in 24 industries, Kevin Prall, “ESG 7.

Ratings: Navigating Through the Haze,” blog posting at CFA Institute, 10 August 2021

10 Study on ESG ratings of 400 companies in 24 industries, Kevin Prall, “ESG Ratings: Navigating Through the Haze,” blog posting at CFA Institute,

10 August 2021

11 In the future, we envisage a fourth category of uncontracted or non-formal data sources, such as public sources, NGOs, general or specialist

press articles or industry bodies, which could help inform or complement data sets or scores.