Summary

The build-out of renewable energy projects in Switzerland has taken a different trajectory to most of the country’s neighbours. However, there are some of the same forces at work in Switzerland driving the Swiss energy transition. The revised Energy Act referendum of 21 May 2017 (Energiegesetz) states as its goals: (i) to reduce energy consumption, (ii) to increase energy efficiency, (iii) to support renewable energies and (iv) the prohibition of building new nuclear facilities.¹ Europe has seen the renewable sector grow from dependence upon government support policies, designed to springboard various generation technologies, to standalone independent business models that, in many cases, no longer need any state intervention whatsoever.² The renewable energy market in Switzerland has also experienced a similar trend, in particular with regard to solar energy.

|

Key takeaways

|

|

|

Update Magazine III/2020 |

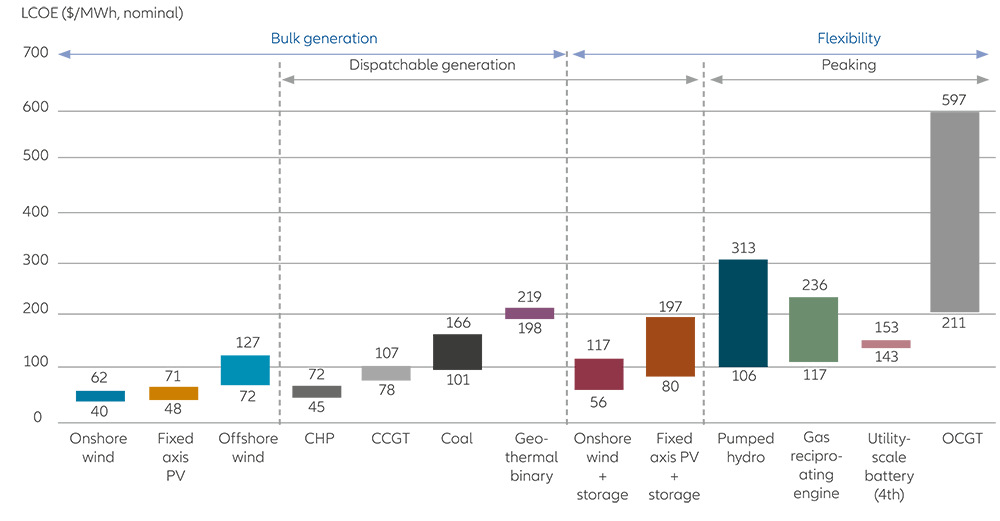

Many of the first investors in the European renewable energy market were pension funds and other institutional investors looking to match longterm annuity obligations to stable and predictable cash flows, with low or no correlation to other capital markets. Such a profile can still be found today, albeit the market landscape has changed. Today, as more capital in the renewable sector is flowing to traditional operational assets, investors are exploring opportunities across different subsectors of the renewable energy space, moving up the project value chain, in order to maintain the same return level. Thanks to increasing efficiencies in construction, and technological advances, the cost of providing renewable energy has dropped dramatically. Solar and onshore wind power are now both as competitive as traditional power generation.3

Source: BloombergNEF. Note: The LCO range represents a range of costs and capacity factors. Battery storage systems (co-located and stand-alone) presented here have a four-hour storage. In case of solar- and wind-plus-battery systems, the range is a combination of capacity factors and size of the battery relative to the power generating asset (25% to 100% of total installed capacity). All LCOE calculations are unsubsidised and exclude curtailment. Categorisation of technologies is based on their primary use case.

The development of a healthy purchase power agreement market is another indication that alternative revenue structures to feed-in tariffs and subsidy mechanisms can also attract new investment in the sector. In this paper, we look at some of the changes that the European renewable market is going through, why these changes make Europe one of the best regions to pick for investing in renewable energy, and how this complements the sector in Switzerland. We also discuss opportunities that Swiss institutional investors have to access this dynamic market environment.

|

|

Download the article here |

Find out more about Infrastructure Equity at Allianz Global Investors

1 Swiss Energy Act; Referendum vom 21. Mai 2017.

2 Irfan, U. (2018). Europe is building more wind and solar — without any subsidies. Vox. Retrieved April 29, 2020, from https://www.vox.com/2018/5/30/17408602/solar-wind-energy-renewable-subsidy-europe

3 Gray, M., & Sundaresan., S. (March 2020). How to waste over half a trillion dollars: the economic implications of deflationary renewa- ble energy from coal power investments, pp. 5, 9-10, 18-19. Carbon Tracker Initiative.

* Forecasts are not a reliable indicator of future results.

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer companies at the time of publication. The data used is derived from various sources and assumed to be correct and reliable at the time of publication. The conditions of any underlying offer or contract that may have been, or will be, made or concluded, shall prevail. This is a marketing communication issued by Allianz Global Investors (Schweiz) AG, a 100% subsidiary of Allianz Global Investors GmbH. The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted; except for the case of explicit permission by Allianz Global Investors GmbH.

AdMaster 1327596

Summary

The Allianz Global Diversified Private Debt strategy provides investors with access to a broadly diversified global private debt portfolio with a strong downside protection⁶. The strategy invests in private debt funds and co-investments that finance mid-sized companies’ needs such as buy-outs, expansion and growth, or restructurings.