Update Magazine I/2023

Secondaries – Second look, first choice?

Private markets now belong to the standard repertoire of professional investing. Even within the segment, special emphasis can be given to certain aspects in a portfolio – for example, through “secondaries.” So, what are these exactly? And why right now?

Just like salt on a pretzel, or Parmesan cheese on pasta, private markets now belong to the repertoire of many institutional investors. These are investments that generally aren’t traded in public markets (see

Private markets aren’t a new invention. On the contrary. Back in 1850, there was something you could describe as the first private market investment with the First Transcontinental Railroad, which ran across the United States and was partly financed by private investors.1 Then there are the endowment funds of U.S. universities, such as Harvard and Yale, which have allocated significant portions of their portfolios to investments in private equity or forests in the recent past, thereby delivering excess returns. Private equity and venture capital alone make up more than 27 percent of the average portfolio of endowment funds.2 When comparing the endowment funds with each other, Harvard Management Company CEO N.P. Narvekar says:

“The more private assets an investor had in its portfolio in FY22, the stronger their performance.“3

However, the challenge of dealing with private markets has exactly the same motto as with conventional investments: “Know your market”. This is because a multitude of possibilities fan out behind the simple catchphrase of “private markets.” And each one has different features. Especially when you look at the less known trends.

Secondary market transactions are a case in point. Put simply, so-called secondaries offer an alternative way to invest in “private markets” or to divest shareholdings. Instead of holding a private markets investment until it is sold or until the end of the fund duration, it can also be sold to another investor or simply acquired by other investors. Especially in the current market environment, this approach is certainly worth a look, as the current uncertainty and market volatility, among other factors, are increasingly forcing investors to adjust their private markets portfolios.

One idea, many varieties

For this purpose, investors typically resort to the secondary market. Depending on supply and demand, some of these investments can be purchased at a discount. Besides a potentially attractive price, there is also the advantage that the capital is placed in existing private markets investments, which speeds up the capital deployment process. In total, this can lead to excess returns and an attractive cash flow profile.

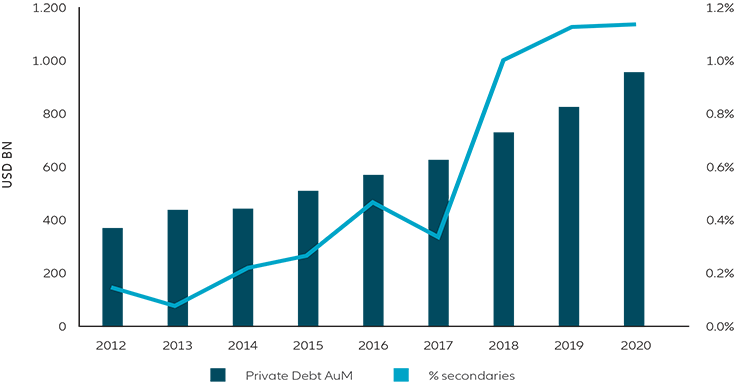

What’s more, secondaries exist not only for one type of private markets investment, but for a whole range of them. “There are active secondary markets in private equity, in private debt and in infrastructure. Especially in the areas of private debt and infrastructure, the secondary market has grown significantly in recent years and therefore offers attractive investment opportunities for experienced private markets managers like us”, says Raphael Haselberger, senior product specialist for private markets at Allianz Global Investors. “Further growth of secondaries in these sectors can be expected in the future as well. This is because there will be more secondary market transactions, based on the strong increase in private debt and infrastructure investments in the portfolios of institutional investors. However, since there are currently only a limited number of specialised purchasers, we expect this imbalance to present many attractive investment opportunities for investors who focus on secondaries.”

A/ PRIVATE DEBT AUM GROWTH AND SECONDARIES TURNOVER

Source: Preqin, Allianz, for illustrative purposes only. A performance of the strategy is not guaranteed and losses remain possible. Allianz Global Investors, 2022.

Especially with private debt and infrastructure, the secondary market has grown strongly in recent years.

Quite clearly, then, secondaries are an investment approach that requires a seasoned hand. At Allianz Global Investors we have a wealth of experience in offering our investors a carefully selected and balanced portfolio that consists of various complementary components – whether it’s different regions and sectors, or different ways to access these markets, such as secondary market transactions. In view of the attractive environment for secondaries, we are also enabling investors to invest specifically in private debt and infrastructure secondaries through specialised fund vehicles. In the process, we offer the advantage of market access and joint investing with Allianz, and we also benefit from our relationships with leading private markets fund managers in the U.S., Europe and Asia. Secondaries may often attract attention only on second glance, but they are one of the first choices in the current environment.

1 Preqin, “The Past, Present and Future of the Industry” (2019)

2 Nacubo/TIAA, “Nacubo-TIAA Study of Endowments” (February 2022)

3 Harvard Magazine, “Harvard Reports …” (October 2022)