Summary

Life as we know it ground to a halt when the pandemic hit. It was a period of social upheaval. Offices closed and schoolchildren were sent home. But then long-lost friends got into contact, and the value of friendship, marriage and family suddenly became a lot more important. Many found themselves stuck at home and alone, craving for companionship.

|

|

Download the article here |

Why pets are good for your health and happiness

Life as we know it ground to a halt when the pandemic hit. It was a period of social upheaval. Offices closed and schoolchildren were sent home. But then long-lost friends got into contact, and the value of friendship, marriage and family suddenly became a lot more important. Many found themselves stuck at home and alone, craving for companionship. Parents needed a healthy distraction for their kids who could no longer meet their friends. And so we saw a dramatic rise in pet ownership during the pandemic. Meanwhile, existing pet owners found themselves spending more time than ever with their pets. Consequently, the pet economy expanded despite many countries experiencing one of the deepest recessions in decades.

What drove the pet economy during the pandemic were high quality food and e-commerce

This boom in the pet economy benefited the US group Freshpet. The company capitalises on the general trend for more healthy, wholesome nutrition. Whilst this is, first and foremost, obviously a trend regarding the human diet, pet owners project these beliefs similarly on their pets. US group Freshpet also became one of the top performing small cap stocks in the Russell 2000.1 The company is currently up over 90 % year-to-date. Another company that has done really well its German-based group Zooplus. Robust online sales helped the company increase revenues significantly. The group expects year-on-year sales growth of between

|

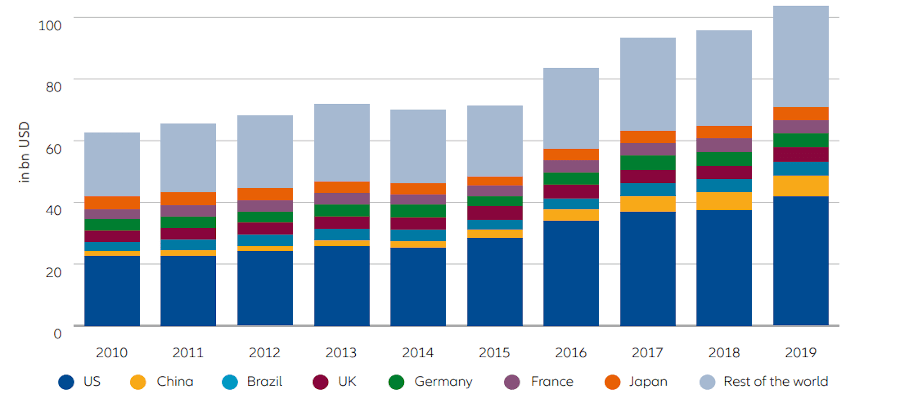

The global market has been growing on average 5.8% annually |

Yet this is not a new trend

Although pet care companies have benefited significantly from the pandemic, it’s worth noting that this industry was growing strongly, long before the outbreak. The global market has been growing on average 5.8% annually.3 Many companies recognised this and have invested heavily into this sector to take advantage of this rapid growth.

This rise in demand is being driven by three powerful forces:

- Millennials: They have been delaying parenthood and have become ‘pet parents’. They now represent the biggest section of pet owners across all demographics.

- Ageing populations: In the developed world, as people are living longer, pets have become an important source of companionship.

- Emerging markets: Increasing affluence in the emerging markets has led to rising pet ownership. For instance, in China the number of households with pets is close to 100 million, while the industry is estimated to be worth over 172.2 billion yuan ($25.02 billion). This is more than three times the size it was five years ago.4

These three trends have led to both a rise in the number of pets and an increase in spending per pet.

Pets have been shown to be good for mental health

Pets are kept for their companionship and have become a valued part of the family. While in the past, dogs and cats were kept strictly outside, they now live permanently in our homes. There is a good reason for this development – it is called the ‘pet effect’. Many scientific studies have revealed that pets have a positive effect on our mental health. For instance, service dogs have saved the lives of many war veterans who have experienced post-traumatic stress disorder (PTSD). Pets have also been shown to help owners manage their feelings and can provide a powerful distraction from pre-existing mental health issues. Therapy dogs are even being used in colleges to help reduce the stress levels of students.5

There is a powerful bond between humans and animals

Both humans and animals benefit mutually from each other, receiving constant companionship, love and affection. It is, therefore, no surprise that 98 % of pet owners consider their pets to be a member of the family.6 The biggest benefit from this bond appears to be health. For instance, scientific studies have shown that cats and dogs can lower your blood pressure and your level of cortisol – a stress hormone. Other benefits include the stimulation of oxytocin, serotonin and dopamine, which are chemicals that help the body relax.7 In fact, studies have even shown that dogs can lessen the chances of developing schizophrenia as an adult.8 This has been confirmed by pet owners themselves. In a survey of pet owners, 74 % reported mental health improvements from owning pets. Meanwhile, 75 % of pet owners also reported that their friends or family members also experienced improvements in mental health from pet ownership.6

|

98% of pet owners consider their pets members of the family |

Animals have long been used for therapy

Since the 1990s, mental health programmes have incorporated animals as part of their treatment. One of the most famous examples is how horses have been used to help troubled teenagers. In the field, it is known as equineassisted psychotherapy. It has helped teenagers deal with depression and anxiety to help boost self-esteem and recover from dramatic life experiences.9 Pets have also been used to help reduce anxiety in children. In a study of 643 children from the US Centres for Disease Control and Prevention, children that owned pets experienced lower levels of anxiety. It concluded that children who grew up with pets have a better chance of being healthier and happier as they grow older.

Global spending on pets continue to climb

2010-2019 in bn USD - Global petcare sales

Source: FT, Euromonitor International.

Pets help people build up healthy habits and routines

Dog owners need to take their pets for frequent walks, runs and hikes. Pet ownership, therefore, has physical benefits as well as the mental ones. Studies have shown that dog owners are far more likely to meet their recommended daily exercise requirements. This helps to prevent heart diseases, which is the leading cause of premature death in the European Union.10 Walking a dog, or even riding a horse, gets you out of the house and is better for your health. You get to spend more time enjoying your natural surroundings, which subsequently can also deliver mental health benefits too. Pet ownership consequently, supports self-care: by looking after an animal, it reminds us to take care of ourselves.

|

Dog owners are more likely to meet their recommended daily exercise requirements, helping to prevent heart disease |

A pet is for life not just for lockdown

Despite all the benefits, pet ownership is a serious commitment. The pandemic has increased the desire for pet ownership, which has caused issues. For instance in the UK, pedigree puppy prices have soared well over 100 % for the most popular breeds between July 2019 to July 2020. Subsequently, there could be a pet welfare crisis looming after the pandemic. However, the overall trend in pet ownership has been increasing for a long time and fortunately, most of these new owners take pet welfare very seriously.

Why invest in the pet economy

Overall, this is a long-term growth trend with many positive benefits. For investors this means that there will be likely a constant demand for pet care, such as food, toys, healthcare, pet accessories and even pet fashion. The pet economy has also proved quite resistant to shocks. It has performed well during the last three recessions: 2001, 2008 and 2020. It is also a market that is growing rapidly in emerging markets, especially China.11 Overall, this is an industry that can offer long-term stable risk-adjusted returns. It is an industry that also continues to boom. And is currently explected to enjoy robust growth and deliver long-term social benefits simultaneously. Investors should, therefore, actively invest into the pet economy.

Allianz Pet and Animal Wellbeing strategy

Allianz Pet and Animal Wellbeing is a pure thematic investment strategy with an exclusive focus on the global pet market. Driven by the megatrend of Demographic Change, we invest in companies across the globe that are directly participating in and benefiting from the pet economy.

A performance of the strategy is not guaranteed and losses remain possible. This is for guidance only and not indicative of any future allocation.

*https://www. grandviewresearch.com/press-release/global-pet-care-market , last updated: 30/11/2018.

**Grassroots® Research is a division of Allianz Global Investors that commissions investigative market research for asset-management professionals. Research data used to generate Grassroots® Research reports are received from independent, third-party contractors who supply research that, as far as permissible by applicable laws and regulations, may be paid for by commissions generated by trades executed on behalf of clients.

Sources:

1 Equities News. (2020, December 9). Freshpet Inc. (FRPT) Breaks into New 52-Week High on December 09 Session. https://www.equities.com/news/freshpet-inc-frpt-breaks-into-new-52-week-high-on-december-09-session;

2 Zooplus AG Capital Markets Day - November 17th, 2020.

(2020, November). https://investors.zooplus.com/wp-content/uploads/2020/11/17112020_zooplus-AG_CMD2020_final.pdf;

3 Evans, J. (2020,

October 18). Petcare market booms as lockdown loneliness drives sales. Financial Times. https://www.ft.com/ontent/91b14818-9e99-4c6bafc5-cec71da05391;

4 China’s pet economy surges to record highs. (2019, July 26). Chinadaily.Com.Cn. http://www.chinadaily.com.cn;

5 Feldman, S. (2020). How Science Supports Pets for Improving Your Mental Health. Mental

Health America. http:https://www.mhanational.org/blog/how-science-supports-pets-improving-your-mental-health;

6 Human-Animal Bond

Research Institute. (2018, April 16). 2016 Pet Owners Survey. HABRI. https://habri.org/2016-pet-owners-survey;

7 Beetz, A., Uvnäs-Moberg, K.,

Julius, H., & Kotrschal, K. (2012). Psychosocial and Psychophysiological Effects of Human-Animal Interactions: The Possible Role of Oxytocin.

Frontiers in Psychology, 3, 234. https://doi.org/10.3389/fpsyg.2012.00234;

8 Johns Hopkins Medicine. (2019, December 18). Early-life exposure to

dogs may lessen risk of developing schizophrenia. ScienceDaily. https://www.sciencedaily.com/releases/2019/12/191218153448.htm;

9 Newman, K. (2018, May 24). More Than Horseplay. U.S. News. https://www.usnews.com/news/healthiest-communities/articles/2018-05-24/horses-help-anxious-teens-in-equine-assisted-psychotherapy;

10 (2020) Leading causes of death in Europe: fact sheet, Copenhagen: WHO

Regional Office for Europe;

11 Agne Blazyte (2020) China‘s pet industry market size 2010-2019, Available at: https://www.statista.com/statistics/1039688/china-pet-industry-market-revenue/(Accessed: 03.12.2020).

Important information:

This document is being presented as part of a management commentary of Thematic Investing strategy portfolios of Allianz Global Investors.

This is no recommendation or solicitation to buy or sell any particular security. A security mentioned as example above will not necessarily be

comprised in the portfolio by the time this document is disclosed or at any other subsequent date.

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested. Allianz Pet and Animal Wellbeing is a sub-fund of Allianz Global Investors Fund SICAV, an open-ended investment company with variable share capital organised under the laws of Luxembourg. The value of the units/shares which belong to the Unit/Share Classes of the Sub-Fund that are not denominated in the base currency may be subject to a strongly increased volatility. The volatility of other Unit/Share Classes may be different. Past performance is not a reliable indicator of future results. Investment funds may not be available for sale in all jurisdictions or to certain categories of investors. For a free copy of the sales prospectus, incorporation documents, daily fund prices, key investor information, latest annual and semi-annual financial reports, contact the Swiss funds’ representative and paying agent BNP Paribas Securities Services, Paris, Zurich branch, Selnaustrasse 16, CH-8002 Zürich or the issuer either electronically or by mail at the given address. Please read these documents, which are solely binding, carefully before investing. This is a marketing communication issued by Allianz Global Investors (Schweiz) AG, a 100% subsidiary of Allianz Global Investors GmbH.

AdMaster: 1447530