Best Styles Equity Strategies

The objective of the Best Styles strategy is to continuously outperform the benchmark – with comparable volatility – in every market environment and across the entire business cycle. We aim to achieve this through a well-diversified mix of successful investment styles, such as Value, Revisions or Momentum.

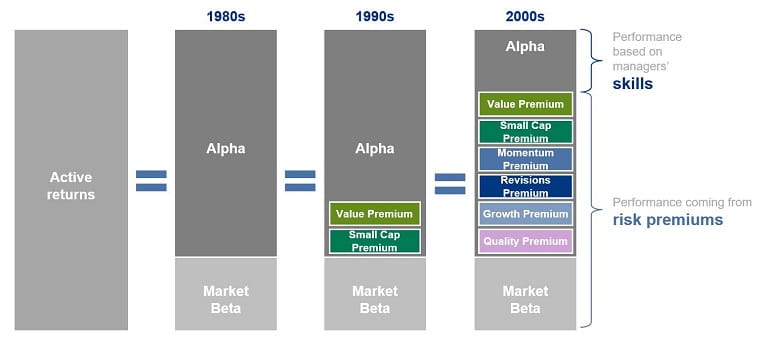

Risk premiums as a stable source of performance

What generates outperformance?

By harvesting risk premiums, reliable outperformance can be achieved without having to accept significant volatility for individual investment styles.

Source: Allianz Global Investors, MSCI.

Optimal diversification is key

Constructing a diversified style mix

Optimal diversification by reducing investment style overlap is aimed for.

Neutralizing non-rewarded risks

Efficient portfolio management should ensure the neutralization of non-rewarded risks such as interest-rate risk, oil-price risk, industry risks or country risks.

Diversifying across different risk dimensions

Best Styles portfolios represent each investment style in its full diversity whilst ensuring broad diversification across different risk dimensions.

A disciplined, systematic approach

- Diversification across investment styles and rigorous risk management can lead to stable excess returns

- Best Styles combines top-down investment-style research and bottom-up company research with rigorous risk management

- Consistent investment process since 1999, stable management team

- Best Styles solutions are available in all major investment regions.

The Best Styles strategy is attractive if you:

- have a longer-term outperformance target

- would like to build up equity exposure in the low-interest environment

- are looking for smart opportunities to harvest risk premiums in the equity market

- place high value on rigorous risk management

- are looking for a consistent investment process

- would like to diversify broadly across different risk dimensions

- are aiming for a high information ratio

- are looking for a diversification-enhancing addition to other equity portfolios due to its low correlation with other strategies

- are seeking an active alternative to passive equity investments

1) Since its inception in 1999, Best Styles Global Equity has outperformed in 16 out of 21 years, reliably accomplishing its objective (as of 31 December 2019). Past performance is not a reliable indicator of future results.

2) As of 31 December 2019

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested.

Investing in fixed income instruments may expose investors to various risks, including but not limited to creditworthiness, interest rate, liquidity and restricted flexibility risks. Changes to the economic environment and market conditions may affect these risks, resulting in an adverse effect to the value of the investment. During periods of rising nominal interest rates, the values of fixed income instruments (including short positions with respect to fixed income instruments) are generally expected to decline. Conversely, during periods of declining interest rates, the values of these instruments are generally expected to rise. Liquidity risk may possibly delay or prevent account withdrawals or redemptions. Past performance is not a reliable indicator of future results. If the currency in which the past performance is displayed differs from the currency of the country in which the investor resides, then the investor should be aware that due to the exchange rate fluctuations the performance shown may be higher or lower if converted into the investor’s local currency.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer companies at the time of publication. The data used is derived from various sources, and assumed to be correct and reliable, but it has not been independently verified; its accuracy or completeness is not guaranteed and no liability is assumed for any direct or consequential losses arising from its use, unless caused by gross negligence or wilful misconduct. The conditions of any underlying offer or contract that may have been, or will be, made or concluded, shall prevail. This is a marketing communication issued by Allianz Global Investors (Schweiz) AG, a 100% subsidiary of Allianz Global Investors GmbH, licensed by FINMA (www.finma.ch) for distribution and by OAKBV (Oberaufsichtskommission berufliche Vorsorge) for asset management related to occupational pensions. The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted.