Summary

We stand at the crossroads of European Union’s (EU) sustainability strategy that is full of turning points with important implications for investors. In its recent reflection paper the European Commission (EC) highlights that it envisions strong future EU economic growth through sustainability transformation and business innovation.¹

By AllianzGI Global ESG Strategy Team2

The EC aims to win GDP Growth and Sustainability in

tandem and estimates an annual finance need of EUR

270bn for Climate, Energy, and Water alone. The potential

global benefits have been estimated to unlock USD 26tn of

economic value through new jobs, well-being, and

competitiveness.* Question remains which economy will

snap up the most of it?

In this Environmental, Social, Governance (ESG) economic

research, we summarise the key EU targets for the

Sustainable Europe Agenda. We start with an overview

about the sustainable development’s status quo in the EU

and put out the key questions. Then we lay out three

potential future EU sustainable development policy

scenarios. As an outlook we highlight the opportunities for

the EU on globalization of sustainability to win the

international race to be the first true sustainability leader.

European Commission’s reflections for Sustainable Development

In a recent 2019 reflection paper, the Commission sees the UN

Sustainable Development Goals (SDGs) as a compass to

achieve prosperous future economic growth in the EU.

Expectations are set high in business success by sustainability

innovation and transformation of sectors and corporates.

Complex environmental challenges require new technology

and business solutions, especially, as the EU is also sensitive

towards the large societal challenges that a rapid

sustainability transformation will bring with potential short

term costs to its citizens and corporations.

Internationally, the EU’s SDG reflections also discuss how

sustainability could exert more strategic independence and

be exported globally.

Ideas to stimulate successful growth via Sustainable Development innovation and investments

How can the EU economy capture its slice of business, and

investors contribute to financing the USD 6tn per annum to

reach the 17 SDGs until 2030? In our view, the responsibility to

commercialize this opportunity lays primarily with the

private sector, with EU crucially supporting and accelerating

this change. For this, a clear political direction with set policy

and economy targets by the EU is desired.

Access to capital and investment opportunities is key. For

example, we think joint private-public partnership (PPP)

desks with active investors can critically bridge SDGs closer

to long-term investors via a much larger scale of project

flow. To achieve these, the EU could promote more

sustainable investment knowledge innovation communities

(KICs).3 Long-term investors, such as pension funds and

insurers will be central.

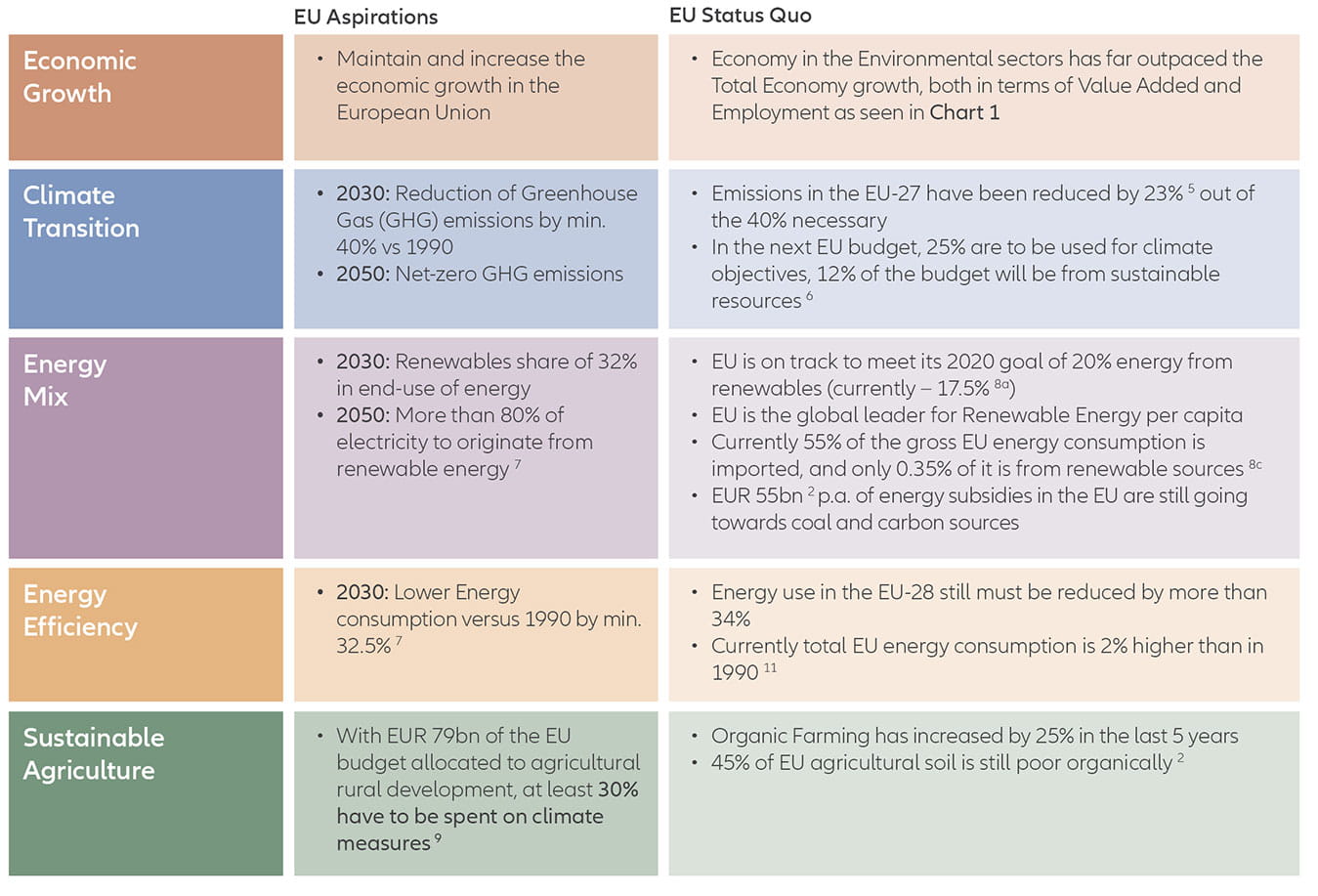

Sustainable Development in the EU4

Chart 1

Change in GDP and Employment of Environmental Economy versus the Total Economy in EU‑288b

Chart 2

Energy consumption in the EU‑28 from 1990 to 201610

Key questions

The turning points still in need of clarification on Sustainable Development in the EU

If the EU see SDGs as a general indicator for the direction of the economy then investors seek answers to:

- How can sustainability technology innovators find a better access to private sector investment?

- What incentives could be given to small, mid and large caps corporates to innovate sustainable services and products with the direction to transform business models?

- How does the EU plan to improve the accessibility/ supply of SDG-related investments for private investors?

- Public-Private Partnerships (PPPs) work - what more roles can they play, e.g. European Investment Bank, European Fund for Sustainable Development, or the European Fund for Strategic Investments?

- Fiscal policy is a powerful tool for policy objectives – how can sustainability driven fiscal policy be leveraged better to achieve global sustainability aims? Should the Finance Ministry Coalition for Climate Action be expanded further?

For addressing these sustainability challenges we outline three potential policy scenarios that may define the Sustainable Europe agenda from an investment perspective going forward.

| 1 | EU takes a soft economic and policy approach to promote Sustainable Development |

In this case, the EU would not interfere much into the private sector activities, if at all. Consequently, the required sustainability innovation and economic transformation would be completely put on the shoulders and appetite of the private sector.

This could be beneficial in avoiding free-rider issue and unintended consequences, through market distortion via subsidies. But it risks the Sustainable Europe agenda being too slow, or opportunities being overlooked by the private sector, potentially leading the EU to fall behind on sustainability akin to falling behind on other new technologies such as Artificial Intelligence.

| 2 | EU gives a principles-based sustainability guidance and provides support |

„Instead of asking what should be regulated, we must ask what can private investment achieve without regulation already”

The EU preferably could engage as a supporter of the economy’s sustainability transition. While more clarity on the EU’s policy and economics targets is wanted, it could reach sustainability equilibrium by guidance, collaboration, and support. For example, setting a carbon price instead of directing how to assess carbon risk.

Such action could create a prosperous eco-sphere for matching sustainability driven business innovation with the investor’s demand for attractive long-term investment opportunities. Active investors should be supported to target the opportunities set by true Sustainable Business innovation in creative Research & Development solutions.

It does take at least two to dance the sustainable development tango. Thus, if the EU was to facilitate it, for example by PPPs and KICs, it would also be important for corporates, start-ups, and investors to take part. Through the EU Sustainable Finance Action Plan, the EU has addressed key components to sustainable investing (Taxonomy, Green Bonds, Climate Benchmarks, EU Ecolabel for green financial products). A leap-frog in mainstreaming could possibly be achieved beyond a green impact investment focus to a broader impact focus that includes many more of the 17 SDGs.

| 3 | EU strongly pushes for innovation in Sustainable Development and adoption within the economy |

Large subsidies and financial support from the EU towards sustainable development themed businesses would be expected if this policy scenario was to come to fruition. To incubate innovation and growth, the EU would have to re-channel subsidies from “the old economy” e.g. thermal coal, into “the new economy” with a focus on sustainability targets. Additionally, new fiscal mechanisms could be introduced such as a carbon tax and dividend scheme for the EU – similar to what is promoted by the Carbon Pricing Leadership Coalition and has been endorsed by over 2,500 leading US economists spearheaded by former US Federal Reserve chair Janet Yellen.11

This will attack the time paradox inherent in most sustainability challenges such as climate change where immediate action is required while there may be no or very limited market incentive to innovate and invest. On the downside, there is a risk of free -riding, lack of true innovation and public discontent due to taxpayers footing the bill as well as administrative complexity being perceived as too much “red-tape”.

Global Race to Sustainability - The future outlook on the international sustainable development

If the EU will be successful as a global leader in sustainability technologies and innovation, including sustainable finance standards and solutions, then sustainability as a trade commodity has the option to lift the EU GDP growth even further as a global export and a trailblazer success. There could also be positive effects via the Generalised System of Preferences through more trade policies and Foreign Direct Investment opportunities in countries also endorsing sustainability, which attracts back to the EU economy.

On the financial standards side, a comparison to be drawn here is the increasing international adoption of International Financial Reporting Standards (IFRS), which were pushed forward by the EU.

In the mid-term, the EU collaboration with China and other countries about sustainability is important for investors, especially if joint standards were developed to ease cross-border investments and joint ventures around sustainability themes and issuer listings for green finance for example. In the long-term, the EU’s global sustainability role can shift due to Africa, e.g. the new Africa-Europe Alliance for Sustainable Investment and Jobs may present new and previously unseen investment opportunities.

In the global race, for the EU to become the leading sustainability economy that achieves high GDP growth and a balanced sustainable ecological footprint (as shown in Chart 3) the jury is out and the stakes are high. The EU has a good starting position but must make the right calls soon.

Chart 3

Countries’ ecological footprint in relation to Human Development12: A race to be first

Data protection policy

By submitting this registration form, you consent to receiving newsletters, advertisements or other marketing material from Allianz Global Investors GmbH (“we”, “our” or “us”). For this purpose, we will process your name, company and e-mail address (“Personal Data”) with your consent.

You can unsubscribe at any time by clicking here without any negative consequences and review, correct and object to the processing of your Personal Data at any time or by contacting us at dataprivacy@allianzgi.com. Each communication that we send to you will also tell you how to unsubscribe. You acknowledge that the Personal Data that you provide to us will be processed in accordance with the information below and our Client Representative Privacy Notice.

For the purposes of data protection laws, Allianz Global Investors GmbH is the "Data Controller" is the "Data Controller" in respect of the Personal Data that you provide to us through this form. With your consent, we will also share your Personal Data with our affiliates in line with applicable data protection laws . We will also use third party service providers to send out our mailings on the basis of data processing agreements. Details regarding our affiliates and third party service providers may be found in our Client Representative Privacy Notice.

The information that you provide to us through this form will be stored in our database and may be combined with other information that we obtain from you in another context (e.g. if you enter into a business relationship with us).

Note that the email messages that you receive from us may be tailored to your profile so that you receive more relevant communications and promotions (e.g. if you are working for a bank you may receive different material than someone from the manufacturing industry). We also keep track of interactions with our marketing emails (e.g. if someone clicked a specific link or whether someone read our email or not). This helps us to better understand our reader’s preferences so that we can constantly improve our services.

Subscribe to our newsletter

|

|

Accelerating economic growth

through sustainability |

* Of great example are the Climate-KIC initiative and Potsdam Institute

for Climate Impact Research, which have helped to foster innovation that

is necessary to tackle climate change. German readers might also find of

interest the article by Prof Hans Joachim Schellnhuber in Perspektive

“Einbindung institutioneller Investoren in nachhaltige Lösungsstrategien”

1) European Commission, Reflection Paper Towards Sustainable Europe, 2019.

2) The views and opinions expressed in this paper, which are subject to change without notice, are those of the author, Global ESG Strategy Team, at the time of publication and do not necessarily reflect the opinion of the issuer and/or its affiliated companies.

3) Garrido, L., Fazekas, D., Pollitt, H., Smith, A., Berg von Linde, M., McGregor, M., and Westphal, M., 2018. Forthcoming. Major Opportunities for Growth and Climate Action: A Technical Note. A New Climate Economy contributing paper.

4) We leave out of the analysis other sustainable development themes, such as, education, poverty, etc, due to the EU already being one of the leaders in these fields or due to the developing methodologies about their measurement

5) European Commission, Two years after Paris – Progress towards meeting the EU’s climate commitments, 2017

6) European Commission, The Multiannual Financial Framework for 2021-2027

7) European Commission, A Clean Planet for all, A European strategic long-term vision for a climate neutral economy, 2018

8) Source: Eurostat a) nrg_ind_ren b) env_ac_egss2, env_ac_egss1, nama_10_gdp, nama_10_pe c) Energy Balances

9) European Commission, EU Budget: the Common Agricultural Policy after 2020

10) Source: Eurostat (nrg_110a)

11) Carbon Pricing Leadership, https://www.carbonpricingleadership.org

12) Data Human Development Index and Global Footprint Network as at 2014 (latest date available)

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Environmental, Social and Governance (ESG) strategies consider factors beyond traditional financial information to select securities or eliminate exposure which could result in relative investment performance deviating from other strategies or broad market benchmarks Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG, licensed by FINMA (www.finma.ch) for distribution and by OAKBV (Oberaufsichtskommission berufliche Vorsorge) for asset management related to occupational pensions in Switzerland; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan];and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.

Summary

This Chinese New Year, more than a billion people globally will celebrate the Year of the Rat. We believe investors everywhere can also find reason to celebrate China as a source of continued economic growth. Even if US-China tensions linger, China’s heavy investment in advanced manufacturing and regional partnerships should strengthen its position as a global economic powerhouse in the years ahead.

Key takeaways

- The Year of the Rat could point to another longer-term period of strategic growth for China

- We think many of Beijing’s top policy priorities could benefit the country’s domestic asset markets, particularly China A-shares

- China’s central bank is aiming to restore the country’s financial system to health by reducing debt – not by employing quantitative easing and ultra-low interest rates

- China will likely try to maintain a steady currency to ensure its purchasing power and consumption

- Some of China’s most interesting investment themes include 5G, electric vehicles, health care, e-commerce and retail