Capital protection strategies

Dynamic Multi Asset Plus (DMAP) strategy

Our Dynamic Multi Asset Plus strategy is an integrated solution for multi asset portfolios that combines active asset allocation over a broad spectrum of asset classes and individual stock-picking within the asset classes with active risk management.

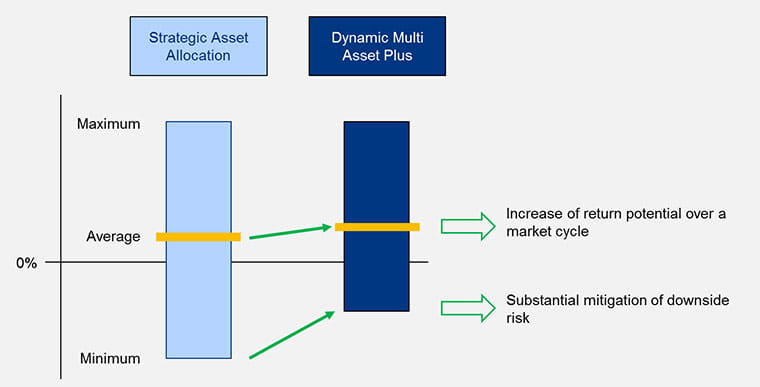

The strategy aims to outperform a static multi asset benchmark over an entire market cycle while, at the same time, limiting downside risk in phases of pronounced market weakness.

The combination of fundamental and systematic strategy components helps us steer our active management through the ups and downs of the financial markets and helps stabilise returns.

Our goal: to enhance returns and reduce losses

Our proprietary approach to active asset allocation combines systematic and fundamental research. It aims to exploit market trends while encompassing an anticyclical component. Our approach is also backed by active risk management, which helps us to lower downside risks considerably during market downturns. It also relies on active stock and bond picking.

A tailored solution

The strategy can be adjusted very flexibly to individual client requirements, for example with regards to hedged asset classes, allocation ranges, strategic asset allocations, and risk and return targets.

Our multi-asset team possesses extensive experience in understanding clients’ specific requirements and offering solutions that are tailored to those requirements that best fit their investment goals.

Strong capabilities & resources

More than 60 years of experience in managing multi asset solutions. A client relationship built on trust supported by more than 90 investment specialists working worldwide on selecting the most promising asset classes. We are one of the leaders in multi asset management (in terms of AuM) and manage more than 130 billion euros for our clients in multi asset and overlay mandates.

These capabilities have been recognised in many awards, which reflect the experience of our fund managers and their successful multi asset investment processes.

We were named the “Best Asset Manager – Multi Asset” for Germany, Austria and Switzerland by FERI EuroRating Services AG in 2016.

In addition to our Dynamic Multi Asset Plus strategy, our diversified multi asset solutions include:

- Capital protection strategies

- Overlay management

- Absolute return solutions

- Alternative asset classes

- Risk-parity strategies

Source: Allianz Global Investors; data as at 30.06.2016. A performance of the strategy is not guaranteed and losses remain possible. A ranking, a rating or an award provides no indicator of future performance and is not constant over time.

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested.

Investing in fixed income instruments may expose investors to various risks, including but not limited to creditworthiness, interest rate, liquidity and restricted flexibility risks. Changes to the economic environment and market conditions may affect these risks, resulting in an adverse effect to the value of the investment. During periods of rising nominal interest rates, the values of fixed income instruments (including short positions with respect to fixed income instruments) are generally expected to decline. Conversely, during periods of declining interest rates, the values of these instruments are generally expected to rise. Liquidity risk may possibly delay or prevent account withdrawals or redemptions.

Past performance is not a reliable indicator of future results. If the currency in which the past performance is displayed differs from the currency of the country in which the investor resides, then the investor should be aware that due to the exchange rate fluctuations the performance shown may be higher or lower if converted into the investor’s local currency.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer companies at the time of publication. The data used is derived from various sources, and assumed to be correct and reliable, but it has not been independently verified; its accuracy or completeness is not guaranteed and no liability is assumed for any direct or consequential losses arising from its use, unless caused by gross negligence or wilful misconduct. The conditions of any underlying offer or contract that may have been, or will be, made or concluded, shall prevail.

This is a marketing communication issued by Allianz Global Investors (Schweiz) AG, a 100% subsidiary of Allianz Global Investors GmbH, licensed by FINMA (www.finma.ch) for distribution and by OAKBV (Oberaufsichtskommission berufliche Vorsorge) for asset management related to occupational pensions. The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted.